By Calvin Schnure, SVP, Research & Economic Analysis, Nareit

Which Pandemic Changes are Temporary, Which are Here to Stay?

The coming year is likely to see significant further improvement in overall economic conditions, with rising GDP, job growth, and higher incomes, in a supportive financial market environment where inflation pressures gradually subside and long-term interest rates remain well below their historical norms. The emergence of the new Omicron variant of COVID-19 in late November 2021 serves as a reminder that the threat of new waves of infection looms over all aspects of the global economy. Increasing vaccination rates and natural immunity due to prior infection may help contain these risks.

Don’t expect commercial real estate markets or the rest of the economy to go back completely to the way they were before the pandemic, however. The pandemic was more than just a shock to aggregate demand. It also changed the way we live our lives, do our shopping, and conduct our businesses. Some of the changes may dissipate over time, while others are likely to be permanent. Nearly every sector of commercial real estate will be impacted one way or another.

As we assess the outlook for REITs and commercial real estate in 2022 and beyond, it is helpful to distinguish between these impermanent or cyclical effects and the longer-term structural changes that result from changes in behavior. The following sections first review REIT investment performance to date during the pandemic, and the outlook for economic activity and overall macroeconomic conditions. The final section considers how the pandemic has made deeper changes in how we live our lives and how this affects how we use commercial real estate.

Overall, the year ahead is likely to build on the recovery that is already underway in the macroeconomy and in commercial real estate markets. REITs are likely to perform well in this growth environment.

REIT Returns During the Pandemic

After posting initial declines early in the pandemic, REIT share prices have recovered as the real estate sector has proven to be resilient. REIT sectors that support the digital economy—data centers, infrastructure, and industrial REITs—rebounded most rapidly in the summer of 2020 as online communications and e-commerce purchases replaced in-person interactions during the period of most stringent social distancing requirements. Other sectors recovered more fully after vaccines against COVID-19 were introduced in November 2020.

Some sectors remain below pre-pandemic levels, including lodging/resorts, office, diversified, and health care REITs. Other sectors, however, have had double-digit returns. Some sectors have delivered exceptional returns, including industrial REITs, with total returns of 57% through November 2021, and self-storage REITs—which have had a surge of demand due to strong housing markets and home sales, plus additional need for space during the pandemic—with investment returns exceeding 70%.

2022 Macroeconomic Outlook

Macroeconomic fundamentals are sound, and except for a few significant obstacles in the near term, growth is likely to continue at above-trend pace in 2022. Job growth has been impressive, averaging 555,000 per month in 2021 through November, reducing the unemployment rate to 4.2%. With total payroll employment still 7 million below the pre-pandemic trend, the job market and the overall economy have considerable running room ahead.

Bolstering the outlook is the fact that all major sectors of the U.S. economy are in a stronger financial position than they were at a similar point following past recessions. Household aggregate net worth has risen to a record high of $142 trillion as of mid-2021, up 21% from 2019 due to rising stock prices and housing prices. Debt levels are also more sustainable than they had been in the past. Debt service represents 13.8% of disposable personal income, according to the Federal Reserve, compared to over 17% in 2008-2009. (These aggregate statistics do not reflect the unevenness of the recovery across different groups in the country, which has resulted in significant inequalities. These inequalities are an important concern, but it is the more favorable aggregate position that largely drives consumer spending and GDP growth). In addition, nonfinancial corporations and commercial banks are in much stronger financial positions today than they were in 2009-2010.

Three obstacles are challenging the outlook over the near-term: ongoing high levels of COVID-19 infections, production and supply chain bottlenecks, and an elevated inflation rate. First, the pandemic continues to hold back many types of economic activity that involve face-to-face interactions, including employees’ return to the office, business travel, and many forms of entertainment. Second, the supply chain issues are well known, and have restricted auto production and availability of many types of goods. Finally, the CPI has risen 6.2% over the past 12 months, well above the Federal Reserve’s target, raising the possibility of higher interest rates to slow the economy to prevent it from overheating. Labor shortages, especially in a few sectors like hotels and restaurants, have limited some businesses’ ability to reopen fully. Most of the inflation pressures have resulted, however, from shortages of key components due to production and supply chain disruptions, and there is little evidence to date that inflation is being driven by higher labor costs.

Yet these three obstacles are interrelated and are likely to ease significantly in the year ahead. COVID-19 infections have not only dampened demand for conferences and theaters, but also have limited the ability to operate ports, logistic centers, and production operations. A reduction in the pandemic, along with new investment in ports and transportation networks, will help ease the bottlenecks that are driving inflation.

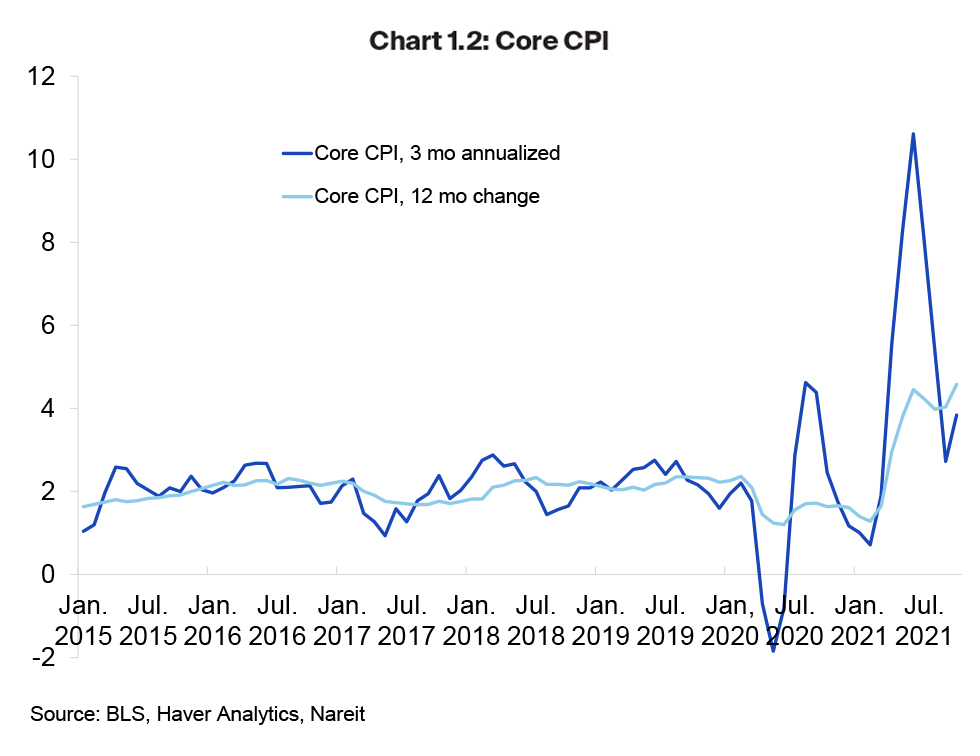

Indeed, there are signs that inflation is not ramping steadily higher, but may in fact have peaked several months ago, when supply chain bottlenecks intensified in May-June 2021. Focusing on the 12-month change in inflation can obscure the rapid changes that have occurred during the pandemic. One gets a more accurate view of current inflation by looking at the three-month annualized change in the CPI. By this measure, core inflation surged to a 10.6% annualized rate in the three months through June, but subsequently has slowed to between 3% and 4%.

Key risks to the outlook: Future variants of COVID; supply chain problems may linger.

Commercial Real Estate—Temporary Versus Structural Changes from the Pandemic

Retail, E-Commerce, and Digital Real Estate

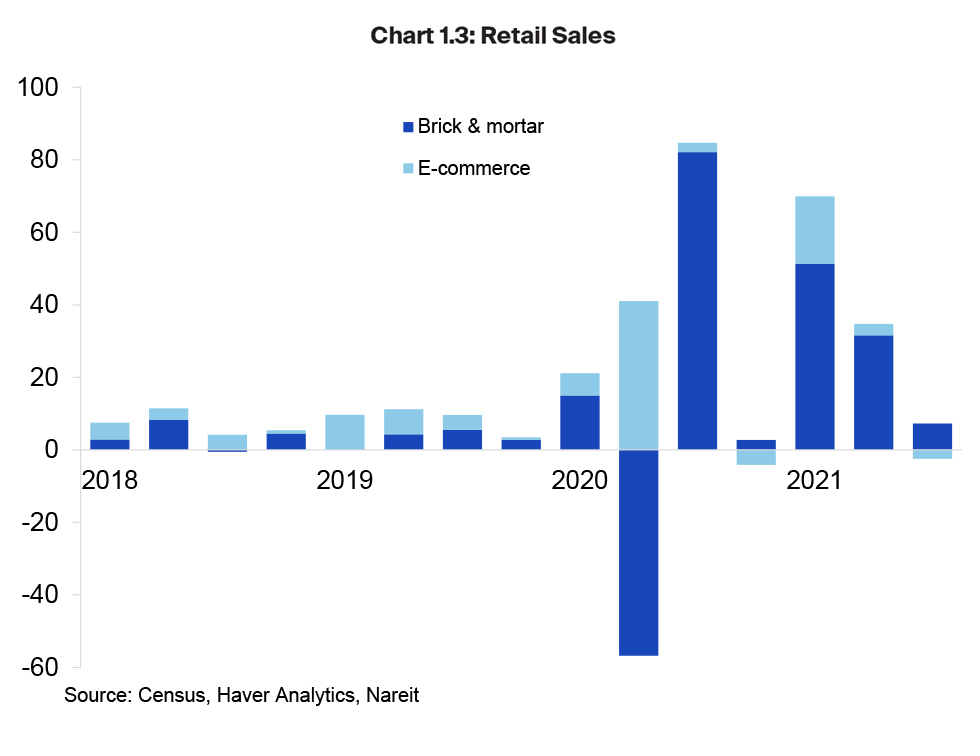

The rise of e-commerce had been changing the way consumers shop long before the pandemic began. Online sales surged even higher in the early months of the pandemic, as shopping centers and malls shut down due to social distancing restrictions. Sales through brick-and-mortar channels fell $57 billion in the second quarter of 2020, while e-commerce sales rose a record $41 billion.

Brick-and-mortar sales came back with a vengeance as stores reopened, however, more than reversing their earlier decline with an $82 billion gain in the third quarter. What is most surprising, though, is that e-commerce sales didn’t fall with the rebound in brick-and-mortar sales, but rather have continued to build on their earlier increases.

Consumers have demonstrated that they still appreciate in-store shopping for certain items, even as they prefer the convenience of online purchases for others. In particular, shoppers often want to check the size and fit and appearance for clothing, shoes, and other fashion items, or they may simply enjoy visiting shops and seeing the displays as a break from mouse-clicks online.

This consumer preference for “more of both” will likely boost the recovery of the brick-and-mortar retail sector in 2022, and also support the continuing long-term growth of REIT sectors that support the digital economy, including industrial/logistics, data centers, and infrastructure/communications towers.

Cyclical factors: The temporary decline in brick-and-mortar retail sales early in the pandemic.

Permanent or structural factors: An ongoing role for in-store purchases for many items, together with online purchases of others.

What to watch for: Upside potential in retail as new tenants sign leases to fill vacant space.

Office

For the state of the office, it is important to ask the right question. Most attention to date has been focused on how quickly employees return to the office. To be sure, the slow pace back to the office by employees who have been working from home has been troubling, but in large part the delays have been the result of continued high infection rates.

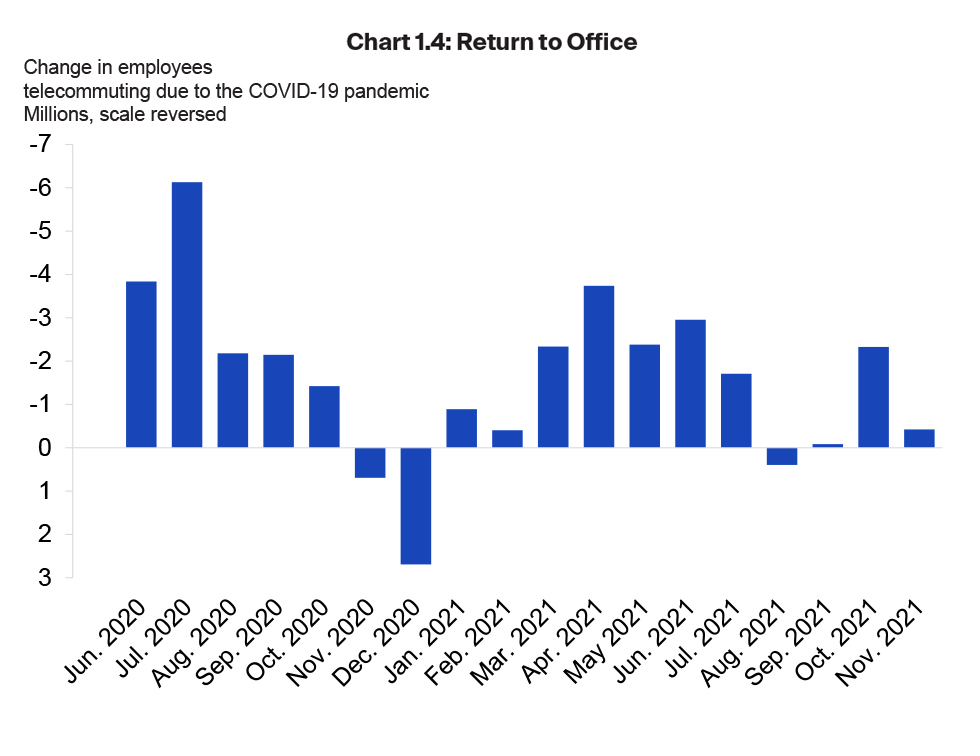

There has been, in fact, significant progress on the return-to-office. In May 2020, 46 million employees reported that they were working from home due to the pandemic. There has been a steady flow over the past 18 months of millions of workers returning to the office, although this trend was briefly interrupted by the surge in cases of COVID-19 in November-December 2020 and again by the Delta variant last summer (chart 1.4). Nearly two-thirds of employees who had reported they were working from home in May 2020 had returned to the office by November 2021, although the pace of return has varied month-to-month according to the rate of vaccinations and infections.

These trends show that workers are coming back, but the pace at which they return to the office still depends on the pandemic. Recent new leases signed by major technology companies confirm that offices are an essential part of the business model. As COVID-19 cases decline, workers will continue to come back.

The longer-term outlook for office markets, however, depends less on exactly when workers return, and more on whether or not new work patterns result in a significant decline in the square footage per worker. In particular, the peak space needs for the days when all employees are in the office for teamwork and communication will drive overall demand for office space. A hybrid model where the office remains the hub of business activity but with a flexible work-from-home policy may utilize comparable amounts of floor space as before the pandemic, but with less density on any given day.

Cyclical vs structural factors: The office will remain the hub of business activity, but many employers will allow flexible WFH on a long-term basis.

Key risk: Office redesign may reduce space requirements.

Key upside: Peak space needs; workers prefer their own desks, files, photos, and coffee mug.

Residential

Across the country, all types of residential housing are experiencing a record surge in demand amidst limited supply. Vacancy rates in multifamily markets are at record lows, driving rent growth to double-digit increases. Housing markets are experiencing surging prices for home purchase and large increases in rents for single-family rentals. Manufactured housing, long considered a more affordable option than traditional construction, is also experiencing strong demand.

Two factors are primarily responsible for these tight conditions. First, there was a supply shortfall even before the pandemic began. New construction of both homes and apartments fell following the housing crisis of 2008-2009, and for most of the past decade remained well below the level needed to keep up with population growth. Second, the pandemic fed a desire for more space, especially as people worked or studied from home all day. People who previously had shared a home or apartment with roommates or family members suddenly wanted a place of their own.

There is no end in sight for these tight conditions in housing and apartment markets, as the supply shortfall is estimated to be in the millions of housing units. Construction has increased, but shortages of labor, materials, and available land given zoning restrictions will keep the new supply from filling the gap for at least several years. In the meantime, rents and prices will remain high.

Cyclical vs structural factors: The surge in house prices and rents will likely slow in the year ahead. With significant supply shortfalls, however, tight markets for both homes and apartments will persist far into the future.

What to watch: Affordability problems worsening, leading to financial strains and also limiting future rent and price increases.

Other Property Sectors

- Lodging/resorts have benefitted from a full recovery in leisure travel, but business travel remains depressed. International travel also has been impacted by the pandemic, reducing the flow of foreign tourists. Look for further improvements in business travel as offices reopen and conference schedules resume.

Cyclical vs structural changes: Business travel should have a cyclical rebound as the pandemic eases. Some business travel and convention activity may remain online, however, so there may be a long-term structural result that the recovery is not complete. - Self-storage has had a banner year in 2021, building on its strong performance in 2020. Strong housing markets and greater mobility in an era where some employees continue to work-from-anywhere all fuel demand for storage. There may be some downside risk if a reduction in employees who are working from home decreases the need to clear out spare rooms in homes and apartments.

Cyclical vs structural changes: Self-storage is riding a longer-term wave that is likely to remain robust due to strength in housing markets. - Health care began a cyclical recovery in late 2021 as occupancy moved higher in senior housing (both assisted living and independent living) and in skilled nursing. Longer-term structural issues include costs of protecting against infection in residential settings, but also strong demographic demand ahead as the Baby Boomer generation ages.

Key risk: COVID-19 infections.

Key upside: Long-term demographics.