Highlights

- REITs outperform PERE funds in head-to-head comparisons.

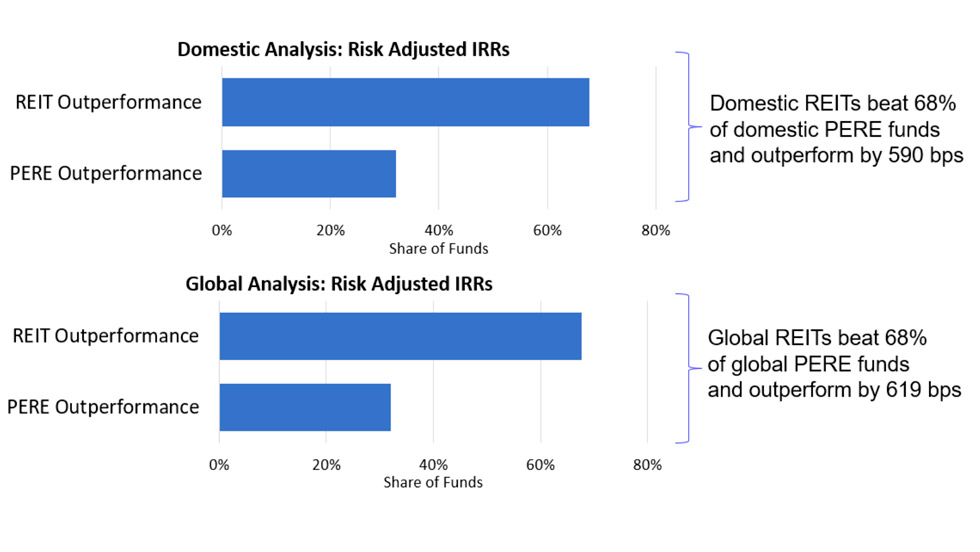

- REITs won 68% of head-to-head matchups against both domestic and global PERE funds.

Download the executive summary

New research by a team of academic researchers and practitioners compares private equity real estate (PERE) fund performance with REITs over matched investment horizons.

The team was comprised of Thomas R. Arnold, David C. Ling, and Andy Naranjo. Arnold is the former Global Head of Real Estate of the Abu Dhabi Investment Authority. Ling and Naranjo are both professors specializing in real estate at the University of Florida. The full research is published in the Journal of Portfolio Management Real Estate Special Issue 2021. The research was sponsored by Nareit.

The study, Private Equity Real Estate Fund Performance: A Comparison to Listed REITs and Open-end Core Funds, uses a unique data set comprising 375 U.S. and 255 international PERE closed end funds with vintages from 2000 to 2014.

The study analyzes whether investors in each of the PERE funds would have enjoyed higher return by investing in REITs.

REITs outperformed PERE funds by a wide margin.

- In the US, REIT returns exceeded PERE risk-adjusted returns by 590 basis points, on average; and won 68% of head-to-head matchups on a risk adjusted basis.

- In global funds, REIT returns exceeded PERE risk-adjusted returns by 619 basis points, on average; and won 68% of head-to-head matchups on a risk adjusted basis.

Interviews with the authors: