REITs and stocks posted their first positive monthly performance since July, as markets began pricing in optimism that the Federal Reserve would slow the pace of monetary policy tightening after the expected November 75 basis point rate hike. Some of the late October gains were reversed when Fed Chairman Jerome Powell indicated that it was premature to consider a pause in rate hikes and markets began to anticipate a higher-than-expected terminal rate.

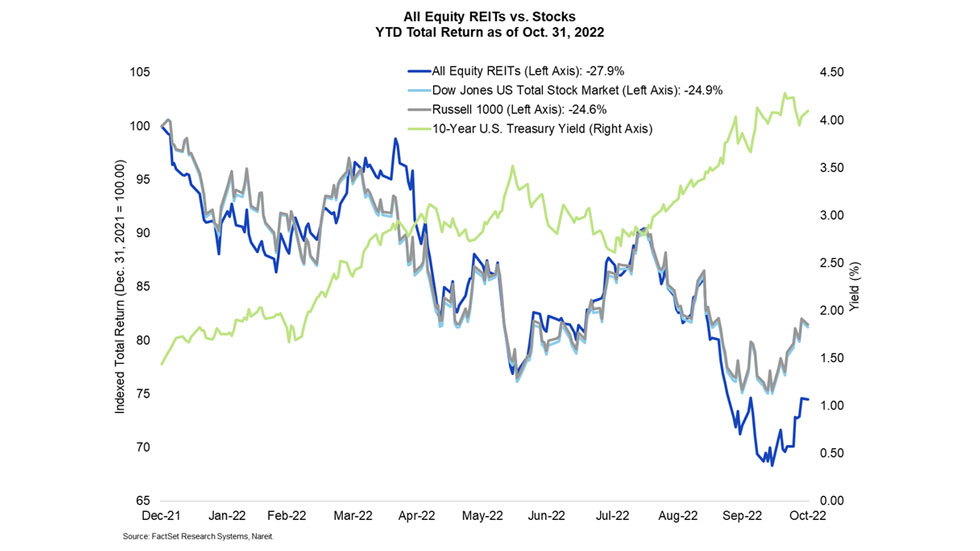

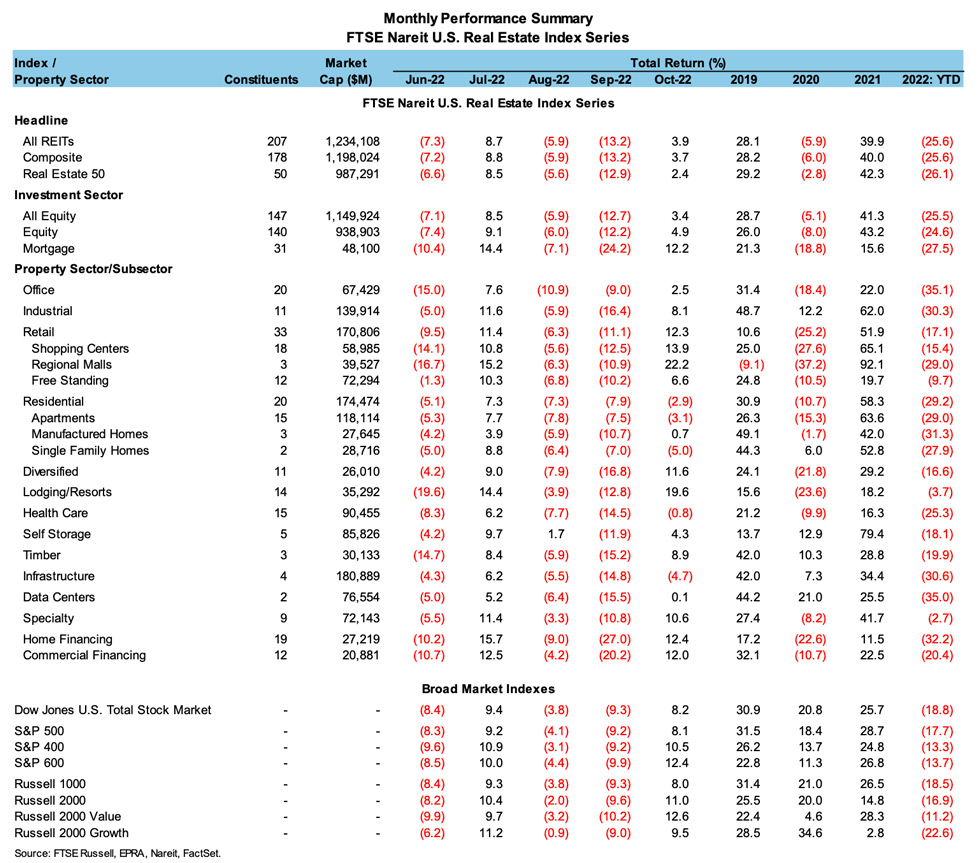

The FTSE Nareit All Equity REITs Index posted a total return of 3.4% and the FTSE Nareit Equity REITs Index rose 4.9% in October. Broader markets posted stronger returns, as the Dow Jones U.S. Total Stock Market rose 8.2% and the Russell 1000 rose 8.0%. The yield on the 10-year Treasury rose 40 basis points to end the month at 4.1%. Through Nov. 4, both the All Equity REITs and Equity REITs indexes have fallen 1.5% for the current month-to-date, while the Dow Jones U.S. Total Stock Market and Russell 1000 are both down 2.7%.

The year-to-date spread between REIT returns and broad market equities continued to widen in October. Through the end of the month, total returns year-to-date were:

- All Equity REITs: -25.5%

- Russell 1000: -18.5%

- Dow Jones U.S. Total Stock Market: -18.8%

Most property sectors were positive in October, led by lodging/resorts at 19.6%, retail at 12.3%, and diversified at 11.6%. Infrastructure, residential, and health care lagged with returns of -4.7%, -2.9%, and -0.8%, respectively.

Mortgage REITs also posted strong returns in October, with a total return of 12.2% for the month, as home financing mREITs returned 12.4% and commercial financing mREITs returned 12.0%.