The U.S. economy has faced numerous headwinds over the last few years. The impacts of the COVID-19 pandemic threw the U.S. into a short-lived recession in early 2020. More recently, surging inflation and rising interest rates have increasingly elevated worries about another U.S. recession. Although the public real estate market has not been immune to these challenges, it has proven to be quite resilient from an operational performance perspective. According to the Nareit T-Tracker®, U.S. equity REITs posted aggregate quarterly funds from operations (FFO) of $19.6 billion in the second quarter of 2022; a marked increase from pre-pandemic and pandemic levels and an all-time high for the measure.

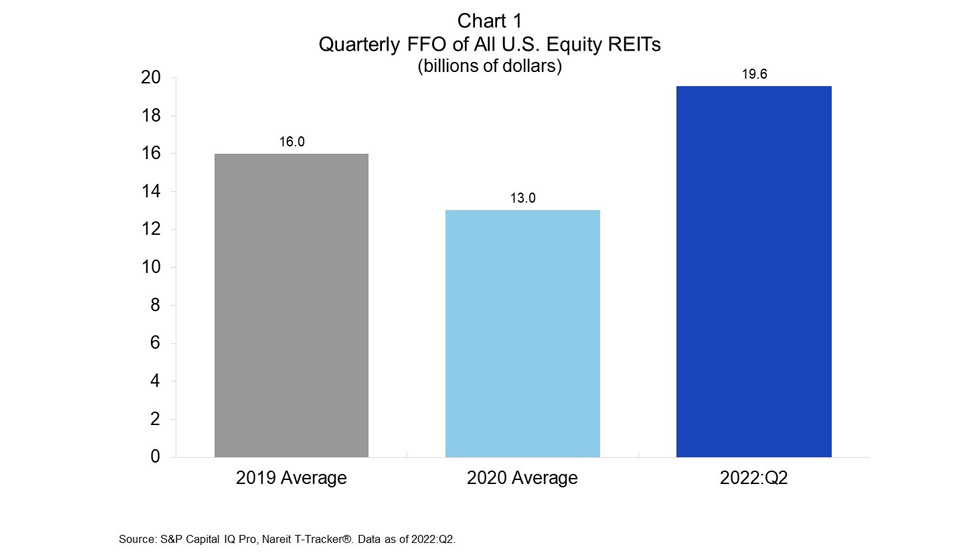

Chart 1 displays quarterly FFO of all U.S. equity REITs in billions of dollars across three time periods. The 2019 and 2020 averages may be viewed as representative of quarterly FFO levels in the pre-pandemic and pandemic periods, respectively. The second quarter of 2022 measure reflects REITs’ most recent aggregate FFO level.

As illustrated in Chart 1, the pandemic clearly took a toll on the operational performance of equity REITs. Average quarterly FFO declined by 18.5% from 2019 to 2020. As of the second quarter 2022, FFO for all U.S. equity REITs reached a new peak. It was 50.1% and 22.4% higher than the 2020 average (pandemic period) and 2019 average (pre-pandemic period), respectively. Despite surging inflation, rising interest rates, and increasing recession risk, equity REIT operational performance has been resilient.

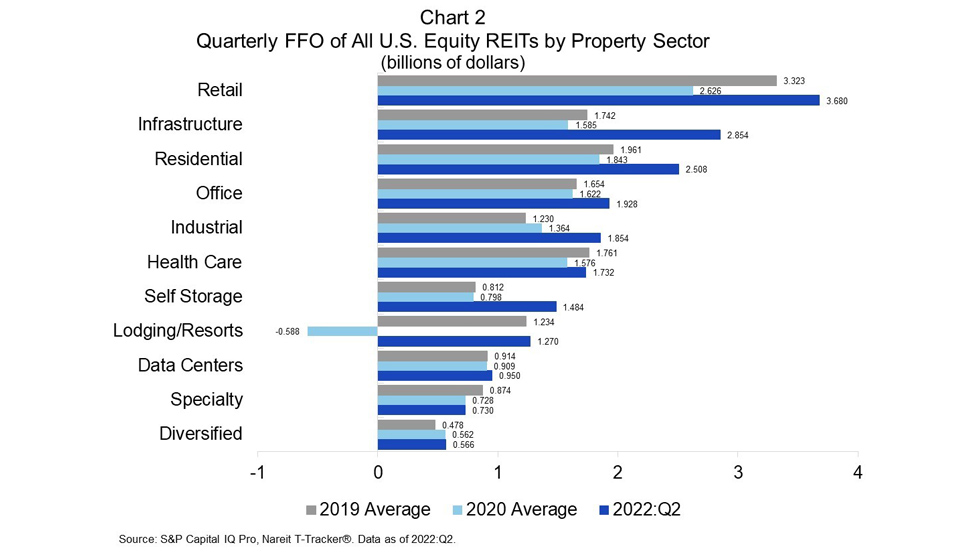

Recognizing that operational performance can differ materially across property types, Chart 2 shows FFO for REITs by property sector. The bar chart highlights the path of each property sector’s quarterly operational performance from the pre-pandemic to pandemic periods and then on to the second quarter of 2022. Property sectors are listed in descending order of quarterly FFO from the second quarter of 2022.

As shown in Chart 2, the COVID-19 pandemic had a material negative impact on operational performance across all U.S. equity REIT sectors, with the exceptions being industrial, which was driven by the rapid growth of e-commerce-based demand, and diversified. In assessing the pandemic-related declines, the most significant woes were experienced by the lodging/resorts sector. With occupancy plummeting to an all-time low, 2020 proved to be an exceptionally challenging year for hotels. As of the second quarter of 2022, the sector’s quarterly FFO exceeded its pre-pandemic (2019 average) levels. Looking forward, the fate of business travel will likely be integral to the strengthening of hotel operations.

Interestingly, the office sector posted an average quarterly FFO decline of just 1.9% from 2019 to 2020. While people were working from home, their employers continued to pay rent. Given the ongoing discussions regarding the impact of work-from-home and the uncertainty surrounding near-term office usage, the relative operational strength of the office sector during the pandemic may come as a surprise to some real estate market observers.

The pandemic, however, proved not to be detrimental for all property types. The data center and self-storage sectors realized near flat average quarterly FFO from the pre-pandemic to pandemic periods. Industrial operational performance has been bolstered by continued high demand for e-commerce logistics needs. The industrial sector posted average quarterly FFO growth of 10.9% from 2019 to 2020; and it experienced an additional gain of 35.9% over the average 2020 level in the second quarter of 2022.

The recoveries from pandemic (2020 average) operational performance levels are evident across all U.S. equity REIT property sectors as of the second quarter of 2022. Furthermore, eight of the nine pure-play property types surpassed their pre-pandemic (2019 average) FFO levels, with only health care lagging. In the current economic climate, these gains are noteworthy. They are a testament to the resiliency of U.S. equity REITs.