Download the PDF of Nareit's REIT Industry ESG Report 2023

REITs are implementing new and innovative programs, adapting to changing physical and social environments, and applying lessons learned over time to provide leadership in the real estate investment industry to effectively address shareholder and stakeholder interests.

The REIT Industry ESG Report 2023 details activities and data in three areas:

- Leading the Way: REITs provide leadership through transparent, effective governance practices that help increase business resiliency and plan for uncertainty.

- Putting People First: REITs continue to focus on developing and supporting people within their businesses and the communities in which they invest, own, and operate.

- Building Resilience: REITs are adapting to and managing the effect of changing climate conditions by focusing on risk preparedness and mitigation, and strategies for reducing carbon that aligns with leading global frameworks.

LEADING THE WAY

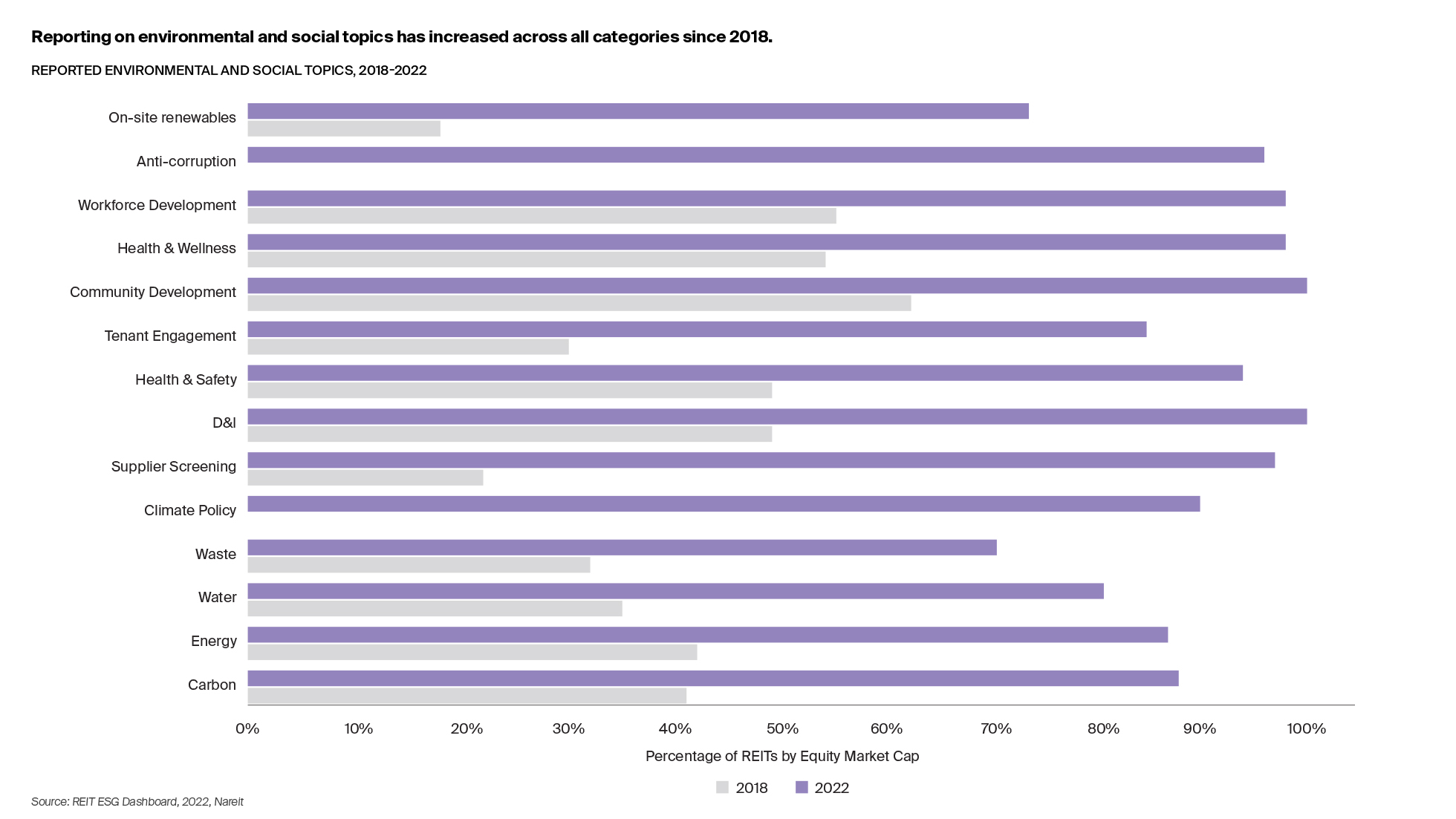

REITs are addressing evolving expectations from investors for information regarding environmental and social issues. The formalization of reporting frameworks is standardizing what many REITs already do to elevate transparency, and strong top-down leadership is supporting the delivery of positive financial, environmental, and social outcomes.

Many REITs have set ambitious targets for environmental and social performance and have put in place management and governance practices to continually assess, revisit, and adjust these targets as they are met and as market expectations evolve. Global efforts to develop financial reporting standards for sustainability and climate risk have led REITs to examine their existing programs and policies for the collection, aggregation, and quality control processes for non-financial metrics used to evaluate, monitor, and disclose the impacts of environmental and social opportunity and risk.

Evolving Reporting Expectations

REITs face some rapidly changing expectations for transparency and reporting on environmental and social matters. As regulation continues to evolve in the U.S. and globally, there is increasing potential for standardization of sustainability reporting inclusion in annual and periodic financial reporting. This anticipated standardization of reporting is intended to provide investors with consistent, comparable, and decision-useful information for making their investment decisions.

Increased Focus on Climate Risk Reporting

Many investors and regulators in the U.S. and globally have emphasized the need for information on climate-related financial risks to make informed, long-term investment decisions.

Some of the key areas on which REITs are currently providing climate-related reporting include the processes through which the board of directors provide oversight of climate-related risk and expertise, the REIT’s carbon footprint, and the climate-related physical and transition risks that have been determined by the REIT to have, or are likely to have, a material impact on their business or financial statements.

U.S. Regulatory Changes and Incentives

Nearly half of U.S. states and several major cities have adopted specific greenhouse gas reduction targets and have started to put building-specific legislation in place to achieve them, including energy performance standards, emission limits, and renewable portfolio standards. In addition, a majority of states have released climate action plans or are in the process of doing so. Many REITs are assessing the impact of local climate bills and developing action plans to meet building performance standards.

Setting Targets, Taking Action, and Monitoring Progress

REITs continue to be thoughtful in setting ambitious environmental and social goals and are working hard to meet, and in some cases, exceed them. The goals increase transparency around how the REITs are managing their impact on the environment and the communities in which they invest and operate. Reporting allows REITs to communicate how they are integrating environmental and social risks and opportunities into their strategies.

Meeting, Exceeding, and Adjusting ESG Goals and Targets

Many REITs are reporting their progress against ESG goals—a central component of their efforts to continuously enhance transparency around ESG performance. Many REITs that were early to set ESG goals are now considering how they can achieve even greater impact going forward and are setting new goals accordingly.

Effective Data Management

The effective collection, collation, and reporting of ESG data is central to monitoring and measuring progress toward goals being met. Access to data is a challenge for many industries. For REITs, the ability to measure full building energy use can be a challenge, which can have implications for a company’s ability to assess and manage performance, and in turn influence its ability to comply with local laws and financial disclosure regulations, as well as meet goals and targets. Many REITs are adopting new technologies to improve ESG data collection and performance.

Reinforcing Accountability at the Top

Many REITs have formed cross-functional sustainability committees with representatives from their boards, C-suites, and other management and operations functions. These committees are responsible for overseeing, developing, and making decisions on ESG initiatives, and they guide organizational ESG goal setting and performance monitoring.

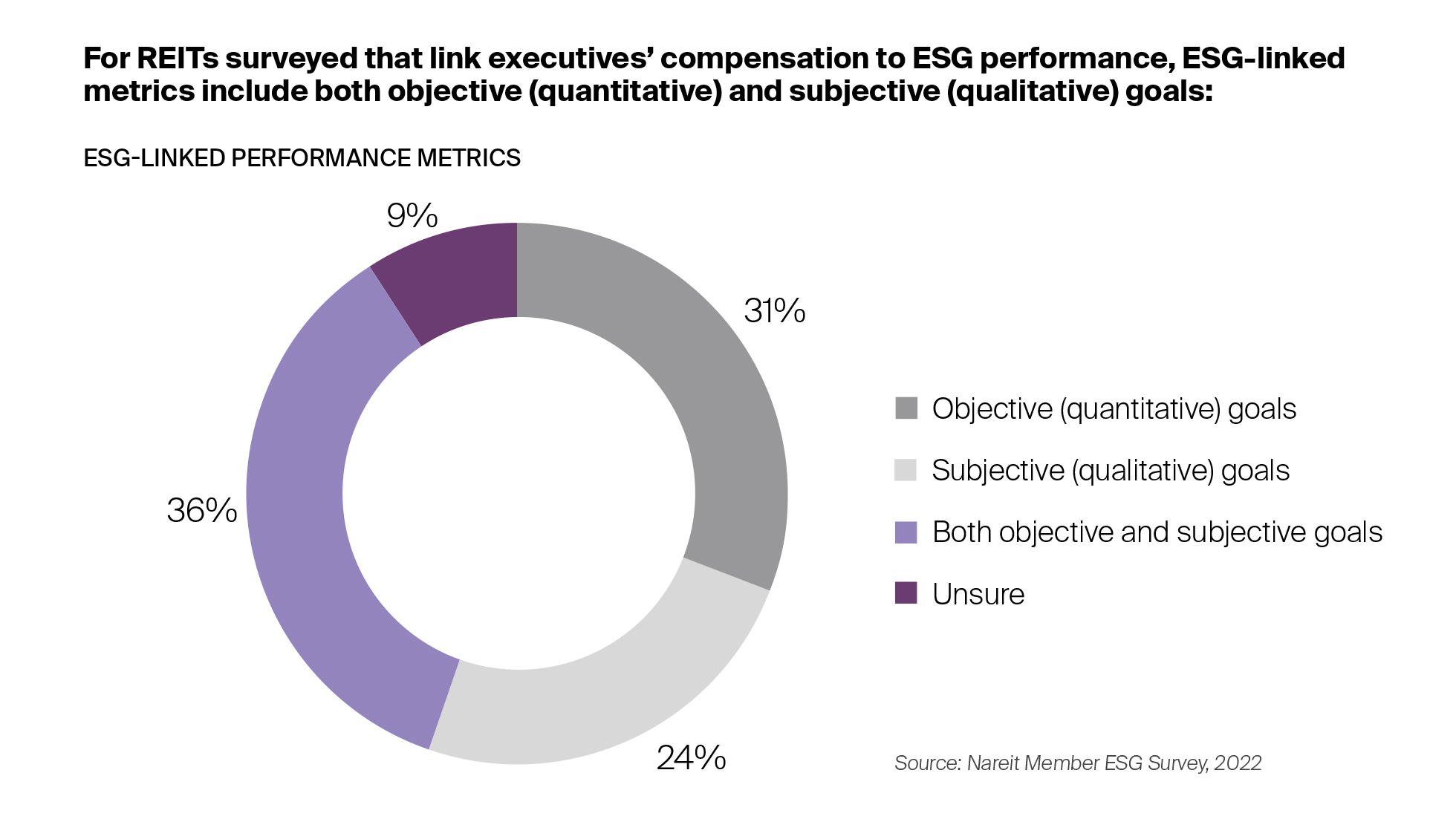

Tying Executive Compensation to ESG Goals and Targets

A leading practice among REITs is linking ESG performance to compensation. Around half of these compensation packages make a direct link to performance against energy use and greenhouse gas reduction targets.

Case Studies:

- American Tower Prioritizes ESG at the Board Level Fostering a Culture of Integrity

- Healthpeak Drives Accountability by Linking ESG Performance to Compensation

- Host Hotels Introduces Long-Term 2050 Vision for Corporate Responsibility

- Effective ESG Governance at Hudson Drives Sustainability Initiatives

- ESG Compliance Preparation at JBG SMITH

- Macerich Making Strides Aligning its Social Impact Strategy to UNSDGs

PUTTING PEOPLE FIRST

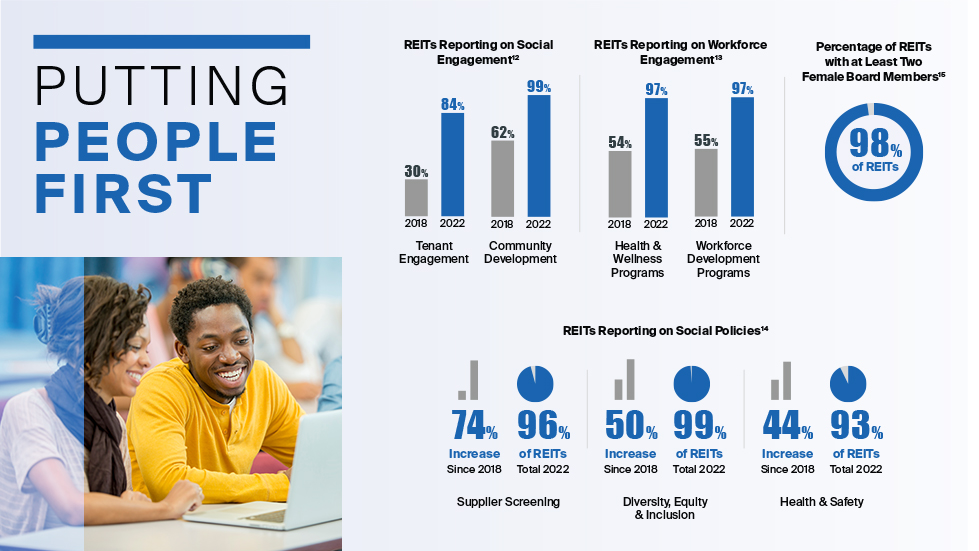

REITs are making efforts to strengthen community ties; support employee needs; and prioritize the health, safety, and wellbeing of their customers, communities, and employees. Through programs that seek to promote inclusion and awareness, such as workforce development and stakeholder engagement, REITs are advancing strategies to grow diverse leaders and promote inclusive business practices.

Many REITs are responding to a shift in how and where people work, which has implications for how commercial and residential properties are being used, as well as addressing the need for greater connectivity with the local community.

Cultivating the Employee Experience

REITs continue to strengthen and expand their approaches to addressing the needs of employees in a changing business environment, practice more inclusive recruiting and hiring, and strengthen employee engagement.

Accommodating Different Ways of Working

Just like many of their tenants, REITs are accommodating and setting the expectations for a greater degree of flexibility and work from home for their employees. In 2022, 76% of REITs surveyed operated using a hybrid working schedule for most employees, and 43% gave employees the option to work non-standard hours; up from 6% in 2021. One in six REITs allowed eligible employees to opt for full-time remote work on a voluntary basis.

Inclusive Recruiting, Hiring, and Promotion Practices

Some REITs are expanding their pipelines for sourcing job candidates and are putting in place hiring practices that seek to reduce unconscious bias or adverse impacts in job postings, the application process, and the interview process. By recruiting from outside the real estate industry and by creating scholarships and internships specifically for underrepresented groups, REITs are increasing the diversity of candidate pools.

Employee Engagement and Wellness

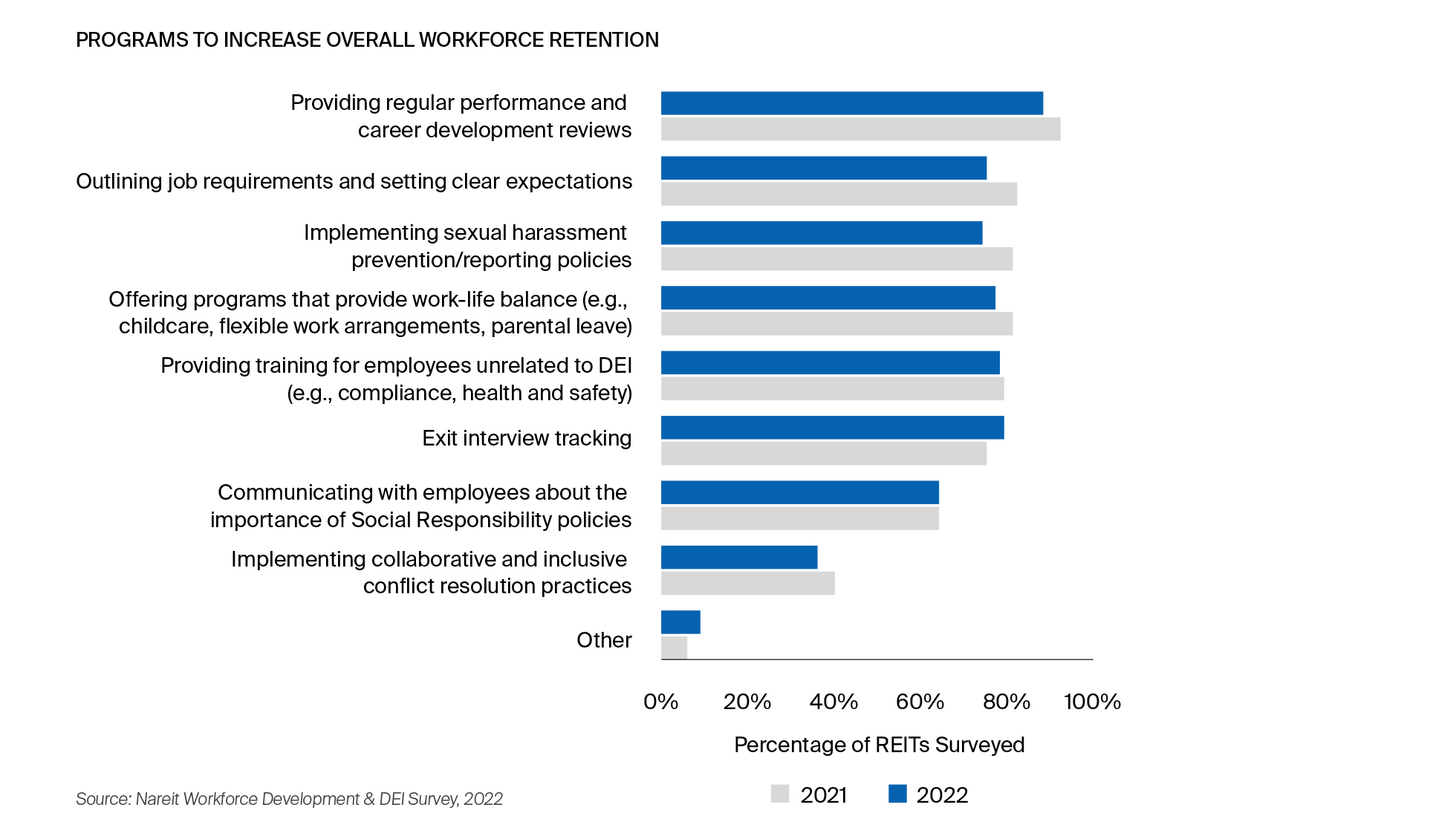

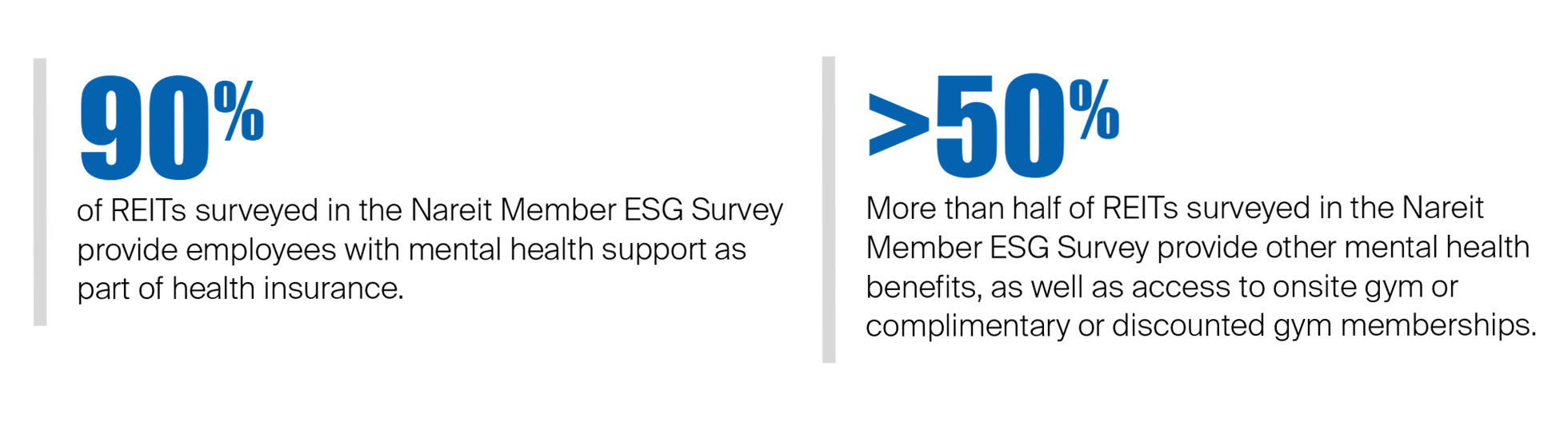

REITs are focused on investing in employees’ growth and supporting health and wellbeing, leading to a more satisfied and engaged workforce. To support a corporate culture that promotes employee health and wellness and to aid in employee retention, 97% of REITs have policies that cover the health and wellness of their employees.

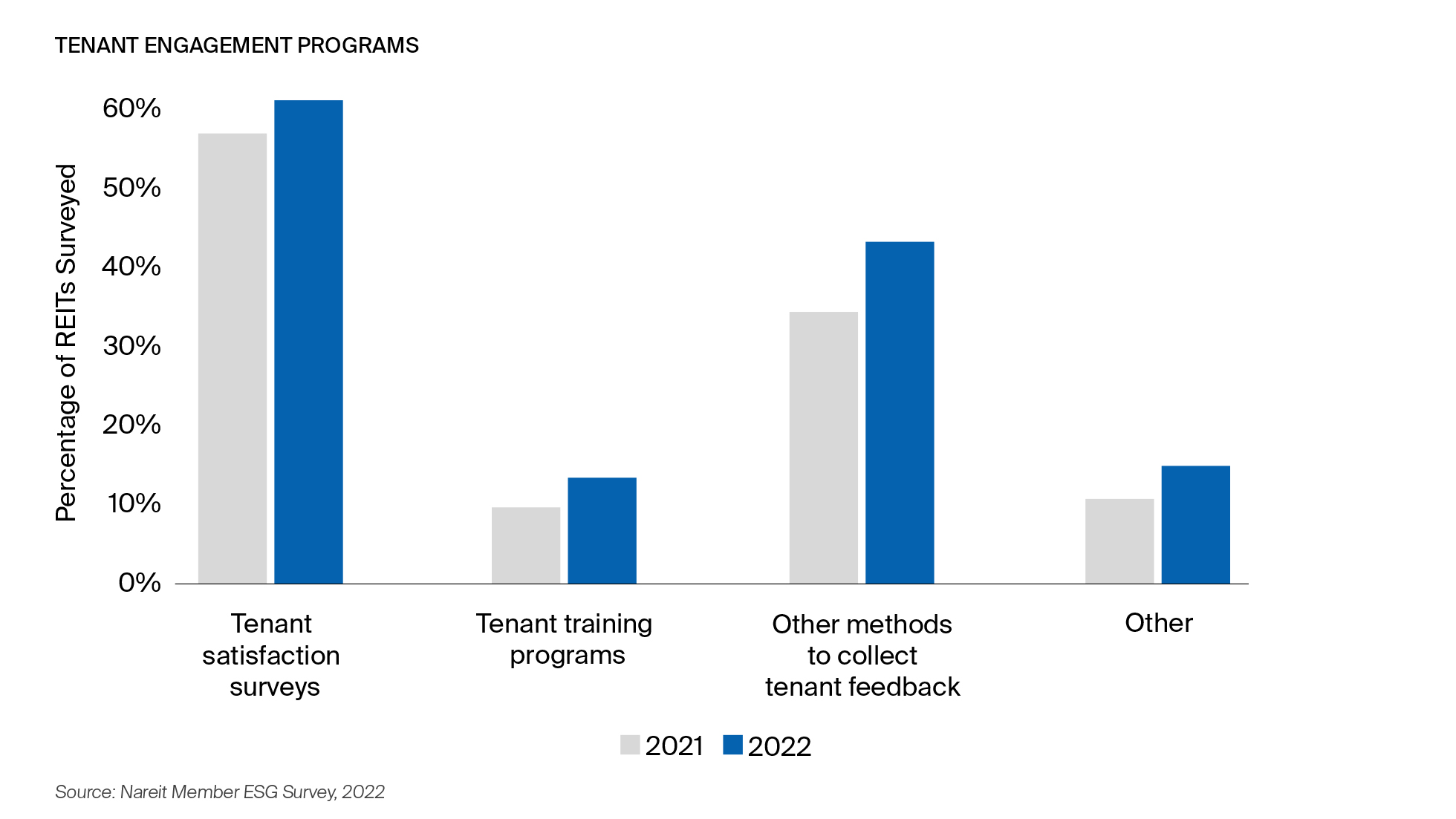

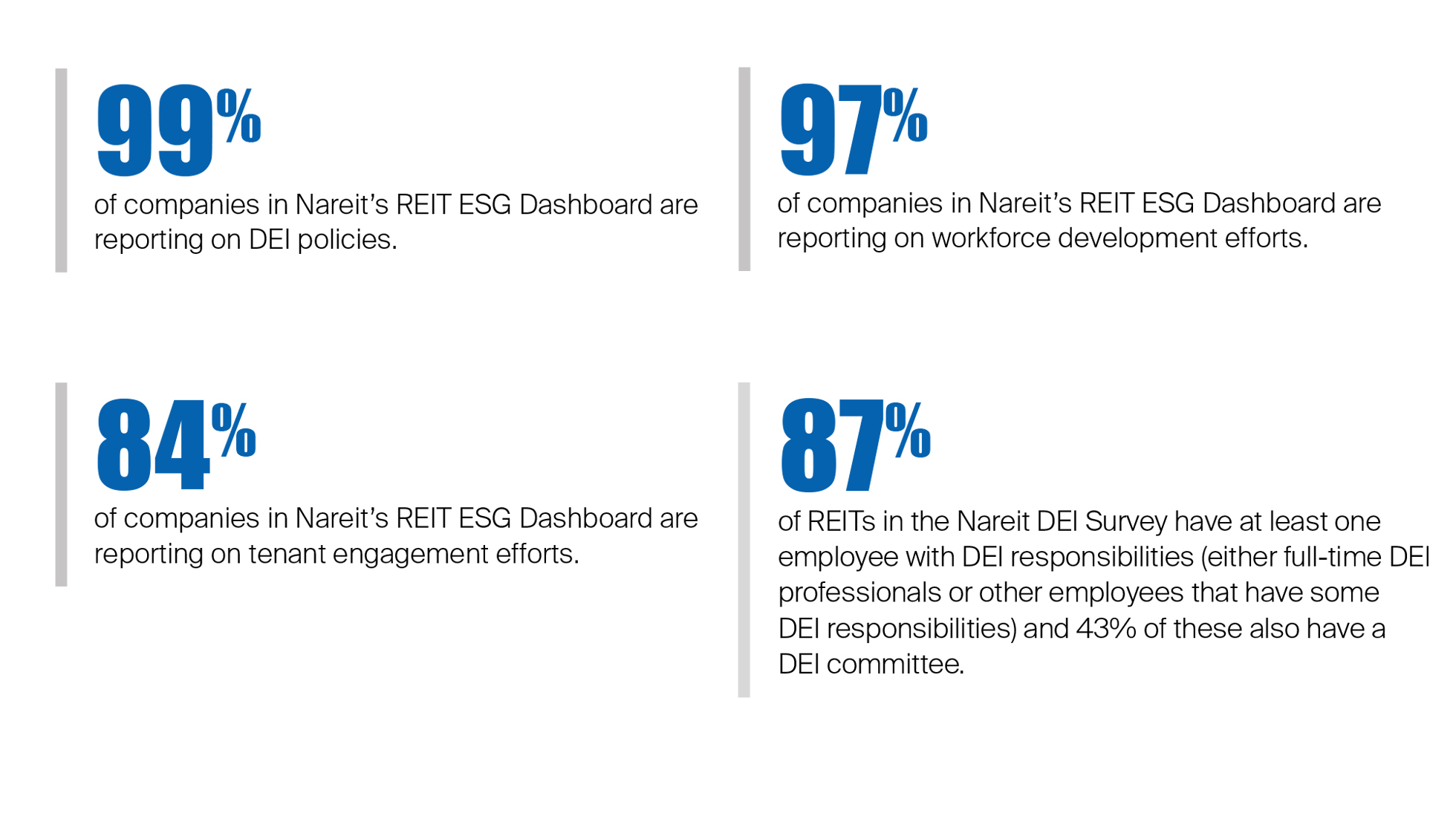

Assessing and Addressing Tenant Demand

REITs are focused on meeting the evolving demand for real estate by developing strategies that drive engagement with tenants and enhance business value. Investors are increasingly interested in how REITs are engaging with tenants on key environmental and social matters, and reporting on tenant engagement has increased from less than half of companies in Nareit’s REIT ESG Dashboard in 2019 to 84% in 2022.

The Changing Business Environment

REITs are working to collaborate with tenants to upgrade spaces and create environments that are supportive of employees. This includes enhancing human, digital, and physical amenities such as improving indoor air quality, creating outdoor meeting space options, and other measures to reconfigure spaces and utilities.

Tenant Satisfaction

To better understand the needs of their customers, REITs rely on various methods to collect feedback from their tenants. While 82% of REITs surveyed have some program to engage with tenants, the most widespread practice is issuing tenant surveys. Tenant surveys provide REIT management teams with valuable information on satisfaction with building amenities, on-site management teams, preferences for frequency of contact, likelihood of lease renewal, and if the tenant would recommend the building or property, a metric that is known as the Net Promoter Score.

Amplifying Community Ties

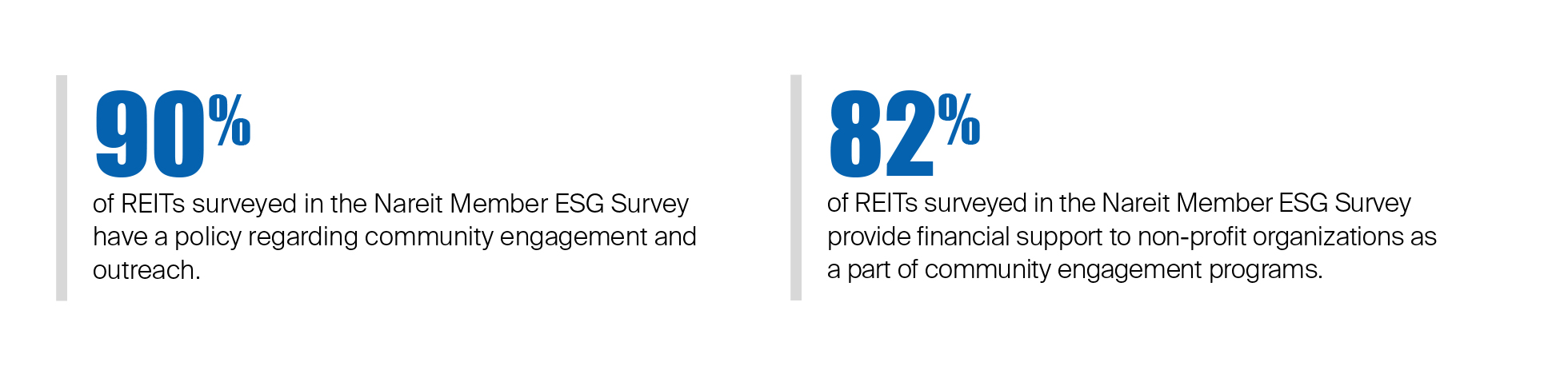

REITs are engaging with local organizations and tenants to be responsible community members. REITs continue to engage in the neighborhoods in which they operate, which is amplifying community ties and supporting increased understanding and responsiveness.

Philanthropic Programs

REITs have the potential to create a lasting and positive impact on the communities where they operate through their philanthropic efforts. During the pandemic, REITs implemented community- centered COVID-19 relief initiatives such as offering rent deferral programs, hosting COVID-19 testing facilities, and more. As they continue to run philanthropic programs that include volunteering and giving, such as hosting food drives on properties, REITs are focused on addressing specific needs in their communities.

Supply Chain Management

REITs continue to set up methods to monitor supply chain processes and pursue meaningful engagement with suppliers regarding ethics and human rights, as well as seek to expand relationships with businesses owned and/or controlled by diverse individuals. Nearly 80% of REITs surveyed have a supplier or vendor policy that covers human rights, 75% that covers non- discrimination, and 40% that covers DEI with suppliers more broadly.

Promoting Responsible Business Across the Board

REITs are focused on efforts to operate their businesses responsibly and are setting clear goals to address inequality and to broaden the range of background, experiences, and perspectives fueling decisions.

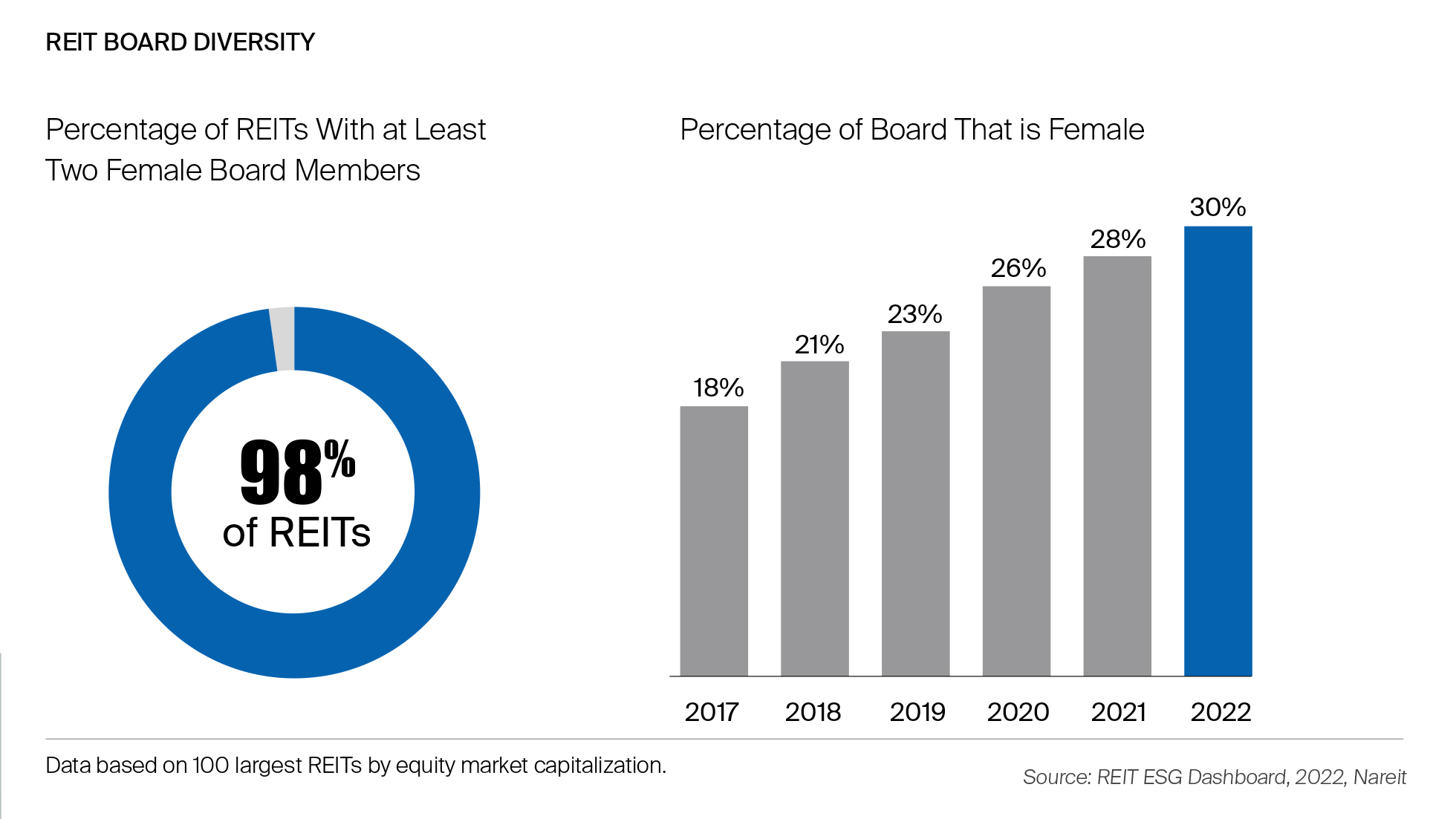

Board Diversity

Setting the tone from the top is important and encourages awareness and drives a supportive culture throughout the business. REITs are making progress—98% of companies in Nareit’s REIT ESG Dashboard have at least two female board members, and in 2022, females represented more than 30% of REIT board members. Ferguson Partners’ 2022 REIT Diversity Across Boards and Executives report found that there was a 124% increase in the number of Black REIT board members between 2020 and 2022, with 53% of new REIT board members in 2022 coming from a racial or ethnic minority. Overall, twice as many REIT boards had at least one minority board member in 2022 compared to 2020.

Strong Social Metrics

Many REITs set formal qualitative or quantitative social goals, and some are tying executive compensation to the achievement of social goals, elevating the need to collect and monitor statistics in these areas. REITs are committing more resources to measuring performance and continuously improving in this area. REITs are hiring dedicated DEI employees or giving existing employees DEI-related responsibilities and increasing ESG-dedicated staff who are responsible for implementing data collection and reporting on social initiatives and metrics.

Case Studies:

- Brandywine Creates Socioeconomic Value Through Community Development

- DEI Leadership and ERG Engagement at Core of Brixmor's Culture of Trust

- Camden Builds Community to Foster Inclusion

- Designing and Curating Spaces for Social Benefit at Howard Hughes Holdings

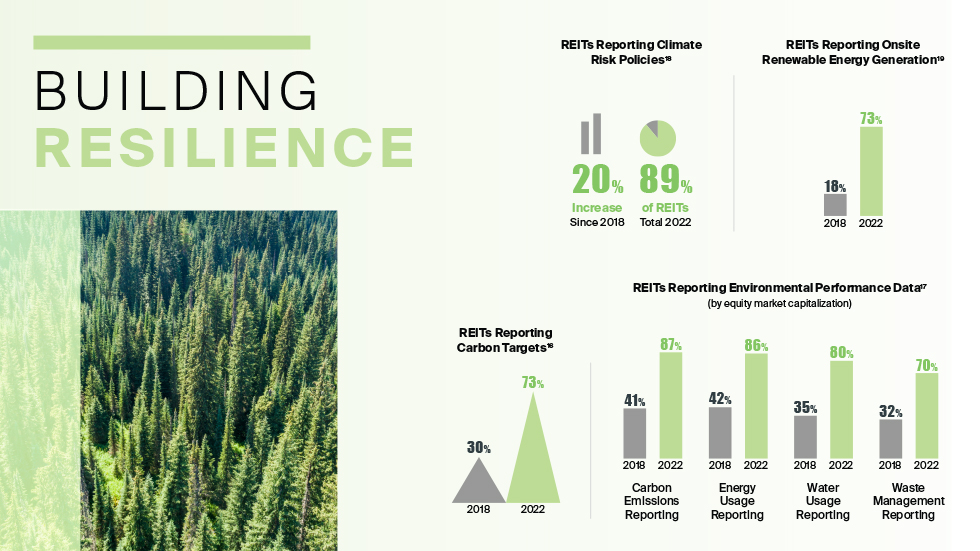

BUILDING RESILIENCE

REITs are addressing climate-related financial risks, acting as responsible environmental stewards by proactively managing the industry’s impacts on the environment, and seeking to understand and mitigate exposure to increasing climate-related hazards by setting out new approaches, financial solutions, and technological innovations.

Anticipated climate-related impacts have the potential to influence where people choose to live, which buildings businesses select to lease, and how investors decide to allocate capital. REITs are implementing strategies and executing plans to mitigate risks, to enhance buildings’ resilience, and to communicate to a range of stakeholders, including investors, employees, tenants, and community members, about efforts to manage their environmental footprint.

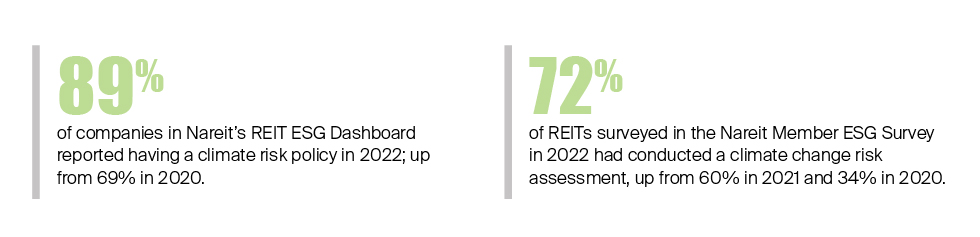

Evolving Business Practices for a Changing Climate

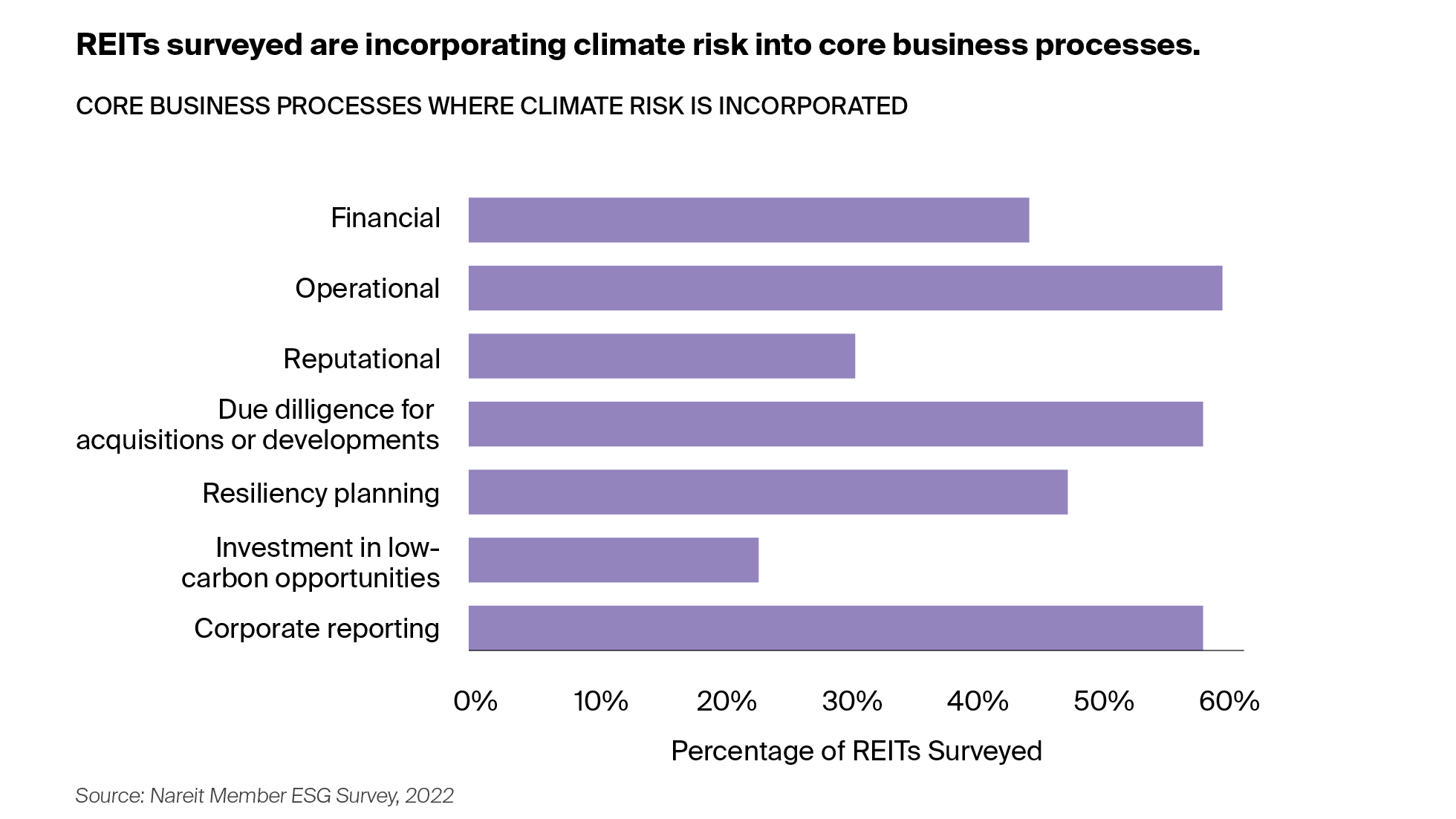

REITs are responding to calls from external stakeholders, including investors, to better understand and mitigate climate-related risks. Many REITs now evaluate exposure to climate-related risks and are using this information to inform core business practices. By embedding climate risk considerations in their investment strategy and management practices, REITs are protecting and enhancing the value of buildings that may be vulnerable to changes in the climate and meeting evolving stakeholder demand for low-carbon, sustainable buildings.

Site Climate Risk Analysis

Climate risk analysis helps REITs understand the financial impacts to real estate investments. Climate risk analysis looks at both physical and transition risks. Physical risks include hazards such as floods, extreme heat, and storms. Transition risks include changes in the market expectations tied to the transition to a low-carbon economy, including regulation, consumer behavior, and technology. Some REITs are utilizing third-party data providers that offer analytical solutions and climate data to conduct sophisticated analyses at their properties. This information can help building owners prepare and engage with local stakeholders, including tenants, community members, and local authorities to prepare for increasing likelihood and severity of extreme weather events.

Investment in Resilient Green Buildings

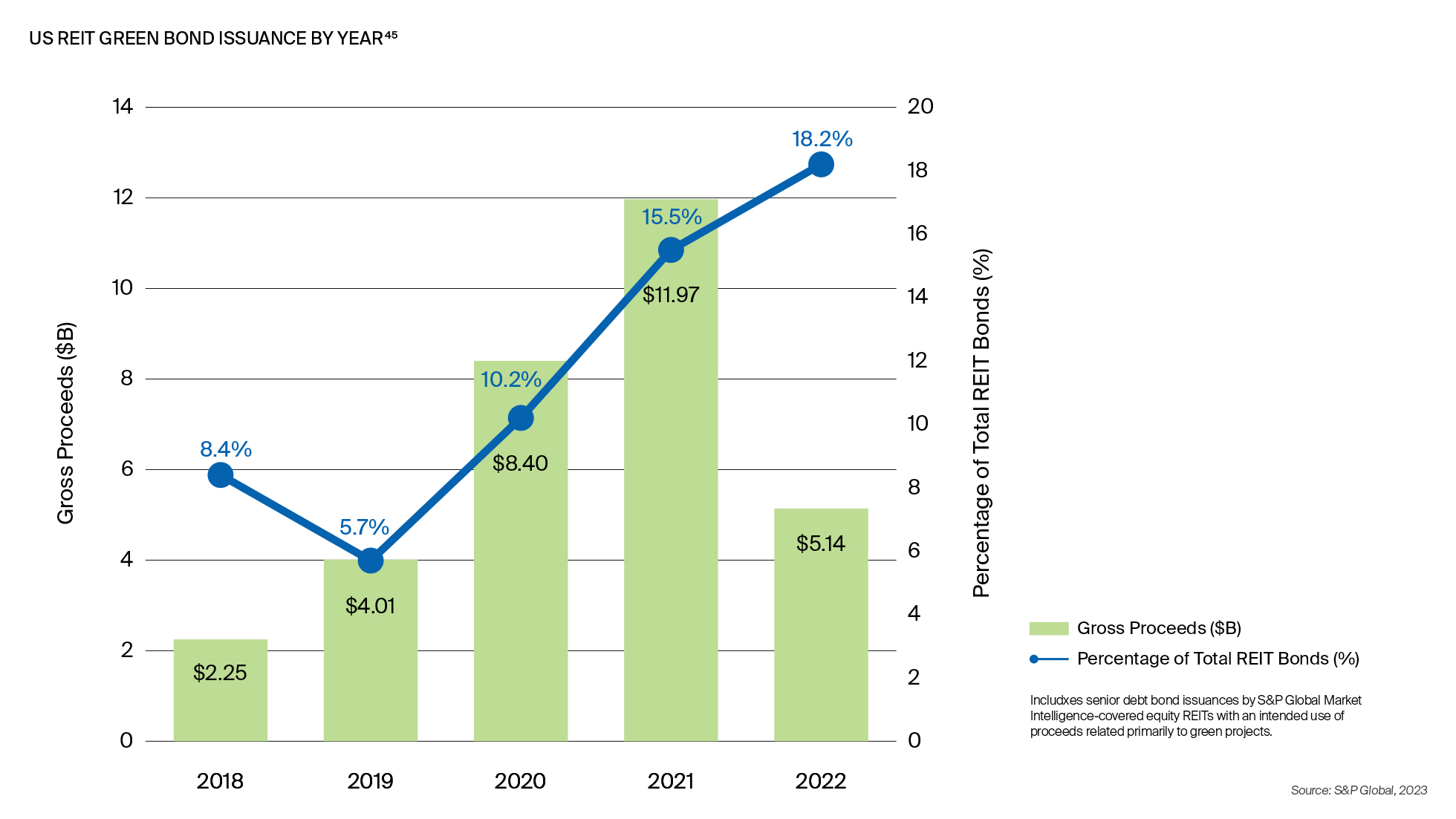

REITs are using sustainable financing methods, such as issuing green, social, sustainable, or sustainability-linked bonds (GSSSB), to raise funds for climate adaptations and environmental improvement projects.

Cutting Carbon in the Built Environment

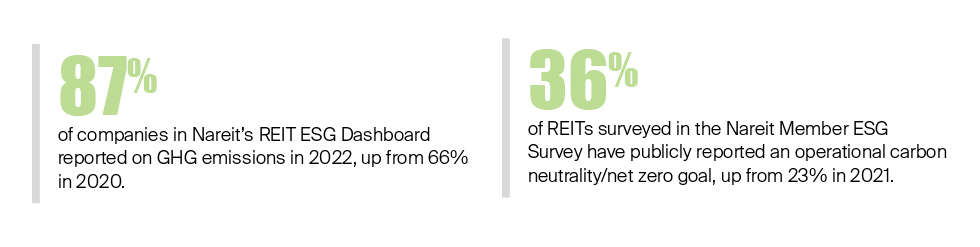

Many REITs have set goals to reduce the carbon footprints of buildings as part of achieving their climate goals. Where REITs have set a decarbonization goal or net zero target for their portfolio, they are transparently reporting on their progress.

Approach to Scope 3 Emissions

Many REITs include direct and indirect, Scope 1 and 2, emissions where they have operational control, in their decarbonization goals and disclosures. Some REITs are beginning to now include supply chain, Scope 3 emissions in their targets and reporting.

Tenant Collaboration on Environmental Management

There is a close link between tenant behavior and a building’s environmental performance, and as a result, tenant engagement is a key area of focus for REITs’ ability to manage and report on emissions. Energy management strategies can benefit the tenant and the landlord by reducing operating expenses for tenants and improving the efficiency of the building, avoiding fines in areas with building performance regulations, and reducing the cost of capital.

Renovating and Updating Existing Buildings

Updating properties with new sustainable building technologies can improve the impact of buildings with outdated, inefficient energy and water systems at a lower cost than major overhauls. Retrofitting existing buildings can improve energy efficiency and support compliance with local regulations, extending the useful life of buildings. It is estimated that 80% of the office buildings that exist today will still be in use in 2050, however, most would not meet today’s energy efficiency standards for new builds

Harnessing Clean Renewable Energy

Powering, heating, and cooling buildings with renewable energy is a critical part of REITs reducing their emissions and can be achieved through the on-site generation of clean energy through rooftop solar panels. It is estimated that REIT properties have 3.5 billion square feet of roof space that could be available for solar generation. REITs may also purchase renewable energy from utility providers or directly from renewable generators through Power Purchase Agreements (PPAs).

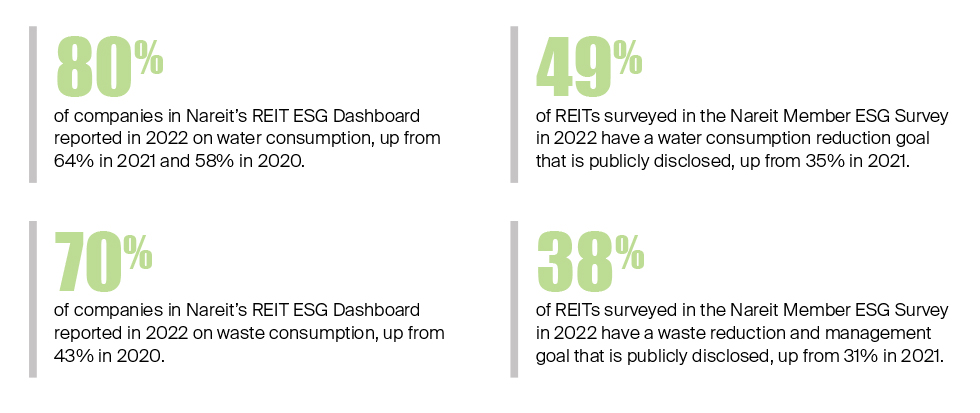

Preserving Natural Resources

REITs are increasing their focus on measuring and managing renewable resource consumption. This is demonstrated by REITs reporting to GRESB indicating that more than 8.3 million cubic meters of water were reused in 2022, which is equivalent to the water in more than 3,250 Olympic swimming pools. REITs also reported the equivalent of more than 92,000 truckloads of waste diverted from landfills to other waste streams in 2022.

Assessing Risks to Nature

Companies and investors globally are calling attention to the importance of biodiversity protection and showing support for the Taskforce on Nature-related Financial Disclosures (TNFD), which will set out a risk management and disclosure framework for organizations to report and act on evolving nature-related risks. The TNFD published its recommendations in September 2023.

Case Studies:

- Greening the Grid for a Sustainable Digital Future at Iron Mountain

- Rexford Industrial's Climate Risk Mitigation Strategy Driven TCFD Assessment and Report

- Climate-Integrated Capital Planning and Renewables at Ventas Integral to Decarbonization Efforts

- How Solar Power Purchasing Agreements are Integrated into Renewable Energy Practices at Alexandria

- AvalonBay is Pioneering an Approach to Protection of Biodiversity

- How Green Leasing Partnerships Fit Into BXP's Sustainability Strategy

- Extra Space Applies Methodological Approach to Solar and Energy Programs

- Kimco's Proactive Natural Disaster Response Protects Local Communities

- Prologis is Cutting Operational Emissions by Supporting Customers

- Partnering with Tenants Supports Vornado's Vision 2030 Roadmap