Key Takeaways

- REITs, on average, have outperformed both private real estate and the broader stock market during and after the last six recessions.

- REITs are entering this period of slower economic growth with strong operational performance and are well-positioned for economic uncertainty in 2023.

- REIT and private real estate valuations will continue to reflect higher interest rates and a slower growing economy in 2023.

- A wide valuation gap exists between REITs and private real estate. This gap will likely close through changes in REIT and private market cap rates in 2023. If this gap closes entirely through adjustments to private real estate cap rates, there could be a 20% decline in private real estate valuations.

By Ed Pierzak Senior Vice President, Research

What's The REIT Outlook for 2023?

In 2023, the U.S. economy will continue to be marked by mixed economic growth results, waning job gains, elevated inflation, and higher interest rates. The confluence of these factors has resulted in increased uncertainty surrounding the economic outlook. In November 2022, the Bloomberg consensus forecast survey placed the odds of a U.S. recession within the next 12 months at 62.5%; the likelihood was 15% at the start of the year.

While property fundamentals generally remained solid at the end of 2022, there has been some evidence of softening going into 2023. The industrial, retail, and apartment property types maintained elevated occupancy rates that were higher than their respective pre-pandemic levels. Office occupancy continued its downward trajectory, dropping nearly 3% from its 2019 average. Four-quarter rent growth rates remained healthy for the industrial, retail, and apartment sectors; office continued work toward maintaining positive rent gains.

Higher interest rates and debt costs are throttling commercial real estate transaction volume. The combination of high rates and weak valuations resulted in a dearth of REIT capital raising in the third quarter of 2022; it is at its lowest level since 2009.

Public and Private Real Estate Market Divergence

Public and private real estate performance diverged in 2022. Public real estate has priced in higher interest rates and slower growth, but the private market response has been sluggish. As of the third quarter, the FTSE Nareit All Equity Index and NCREIF Fund Index–Open End Diversified Core Equity posted year-to-date total returns of -28.2% and 13.1%, respectively; a difference of 41.3%. Note that REIT performance has typically led private real estate performance by six to 18 months. A similar divergence was evident with cap rates.

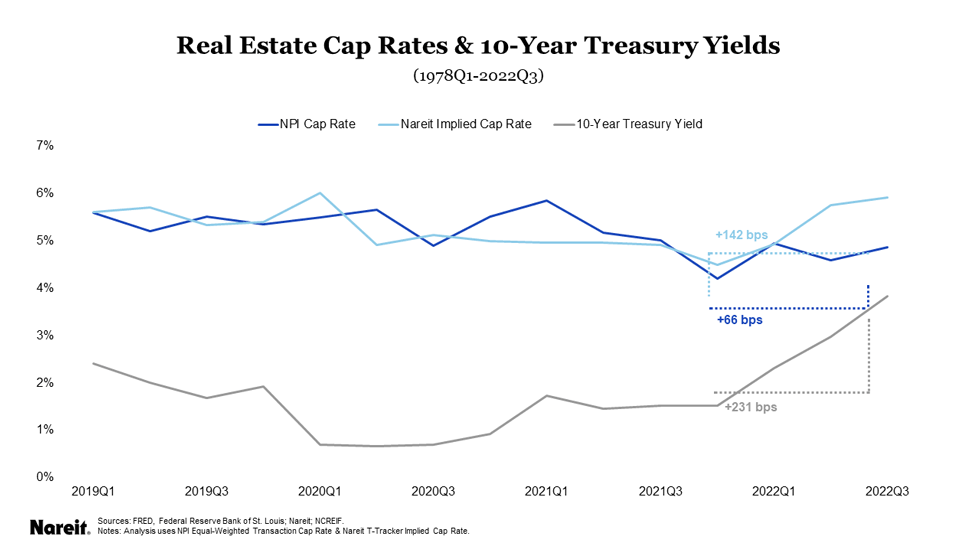

The chart above presents public and private real estate market cap rates, as well as 10-year Treasury yields. The 10-year Treasury yield surged in 2022. Though cap rates do not move in lock step with rising interest rates, the public real estate market had a meaningful reaction to the rise in the 10-year Treasury yield; the private market response was tepid. As of the third quarter of 2022, the REIT implied cap rate exceeded the private real estate cap rate by more than 100 basis points. All else equal, this disparity suggests the potential for a 20%, or larger, decline in private real estate market valuations, but typically, all else is not equal. There are a number of factors that can offset the potential decline, including operational performance, cap rate expectations, and time. In 2023, the gap between public and private cap rates is expected to close, most likely through changes in both REIT and private market valuations.

Real Estate and Equity Market Performance Before, During, and After Recessions

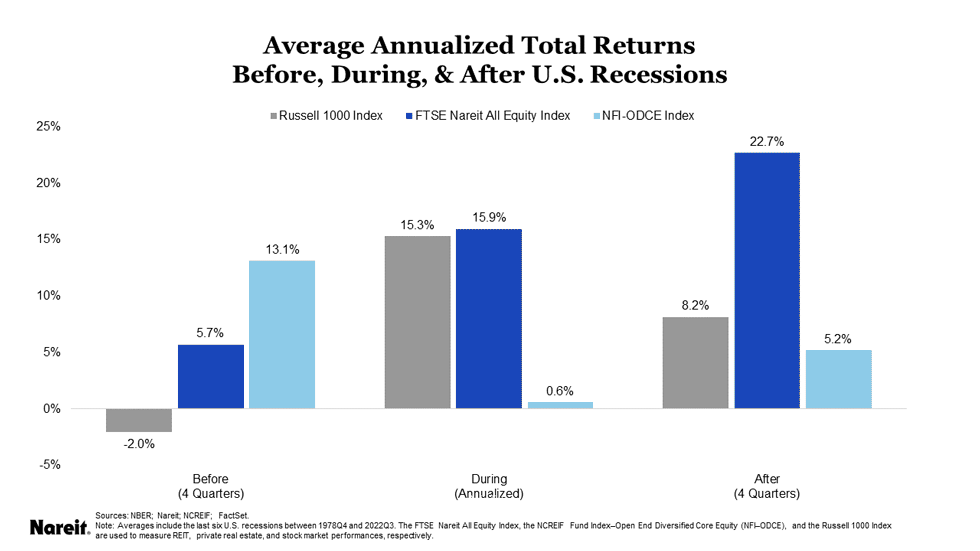

It is a well-known maxim that past performance may not be indicative of future results, but a review of historical public and private real estate total returns, as well as equity market total returns, before, during, and after recessions, may provide a look at what we may expect in 2023 and beyond.

Notably, recessions do not have to equate to negative real estate performance. Furthermore, REITs have traditionally been well-positioned to take advantage of economic recoveries.

For example, the chart above displays the average annualized total returns for public and private real estate, as well as the equity market before, during, and after U.S. recessions. An analysis of the last six recessions reveals that, on average:

- REITs underperformed private real estate in the four quarters before a recession;

- REITs outperformed private real estate during a recession;

- REITs outperformed private real estate in the four quarters after a recession; and

- REITs outperformed their equity market counterpart before, during, and after recessions.

REIT Operational Performance: Market Outlook for 2023

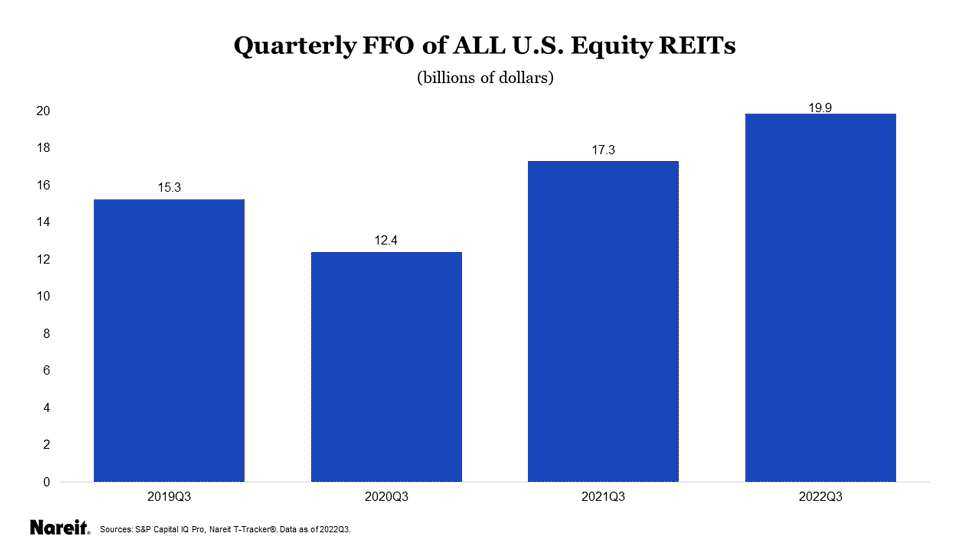

Despite economic headwinds and weakness in valuations, equity REITs have proven to be quite resilient from an operational perspective, and it is clear that REITs are well-positioned for ongoing economic uncertainty in 2023. Data from the Nareit T-Tracker® in the third quarter of 2022 highlighted solid year-over-year growth in funds from operations (FFO), net operating income (NOI), and same-store NOI. With strong operational performance and balance sheets, REITs are well-positioned to navigate economic and market uncertainty in 2023.

The chart above shows aggregate quarterly FFOs of all U.S. equity REITs in billions of dollars for the third quarters of years 2019 through 2022. The pandemic clearly took a toll on the operational performance of equity REITs, but it has recovered and surpassed pre-pandemic levels. T-Tracker ® data for the third quarter of 2022 show that quarterly FFO increased to $19.9 billion—a 14.9% increase from a year ago and an all-time high.

Notably, NOI increased by 8.1% over the past four quarters; and same-store NOI grew by 7.1% from a year ago, which underscores that REIT operational performance is keeping pace with inflation.