The FTSE EPRA Nareit Developed Extended Index rallied in the fourth quarter of 2023 as bond yields declined in the United States and other developed markets. As inflationary pressures have eased, hawkish commentary from central banks has also eased, leading investors to expect more accommodative monetary policy in 2024. As noted in Nareit’s 2024 REIT Outlook, historically, listed real estate has outperformed at the end of central banks rate-rising cycles.

Global Real Estate Performance

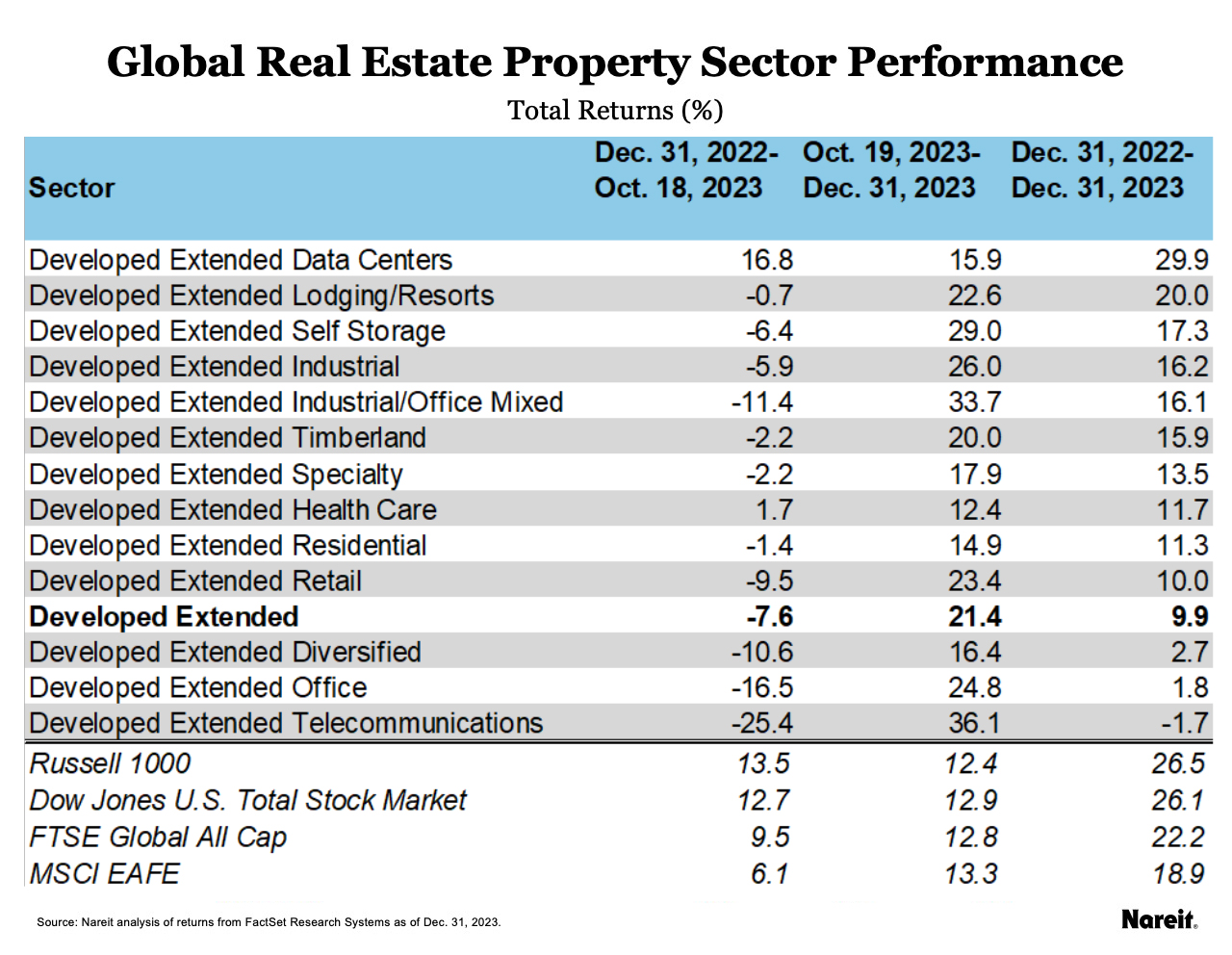

The FTSE EPRA/Nareit Global Real Estate Index Series outperformed broader markets from mid-October through the end of the year. As shown in the above table, the Developed Extended Index posted a total return of 21.4% from Oct. 19, when the 10-year U.S. Treasury yield peaked, through the end of the year. In 2023, the Developed Extended Index was up 9.9%. The FTSE EPRA Nareit Developed Index, which does not include telecommunications real estate or timberland, posted a total return of 20.0% from Oct. 19 to Dec. 31 and rose 10.9% for the year.

Broader Market Performance

Broader equity markets were positive as well, though they trailed real estate. From Oct. 19 to Dec. 31, the MSCI EAFE was up 13.3%, followed by the Dow Jones U.S. Total Stock Market at 12.9%, the FTSE Global All Cap at 12.8%, and the Russell 1000 at 12.4%. In 2023, the Russell 1000 was up 26.5%, the Dow Jones U.S. Total Stock Market was up 26.1%, the FTSE Global All Cap was up 22.2%, and the MSCI EAFE rose 18.9%.

Property Sector Highlights

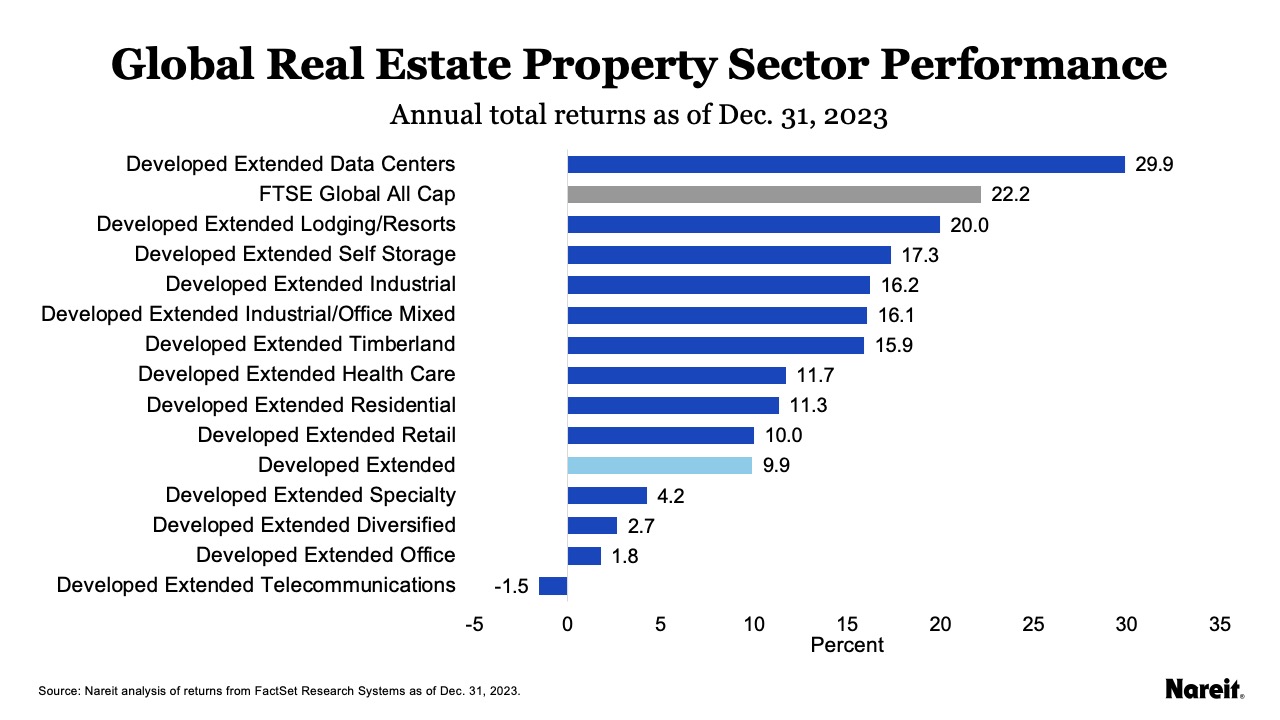

As shown in the above chart, data centers led all real estate sectors in 2023 with a total return of 29.9%, followed by lodging/resorts at 20.0% and self-storage at 17.3%. While telecommunications and office lagged in 2023 with respective total returns of -1.7% and 1.8%, both sectors responded positively from mid-October through the end of the year, as telecommunications rose 36.1% and office rose 24.8%.

Regional Performance

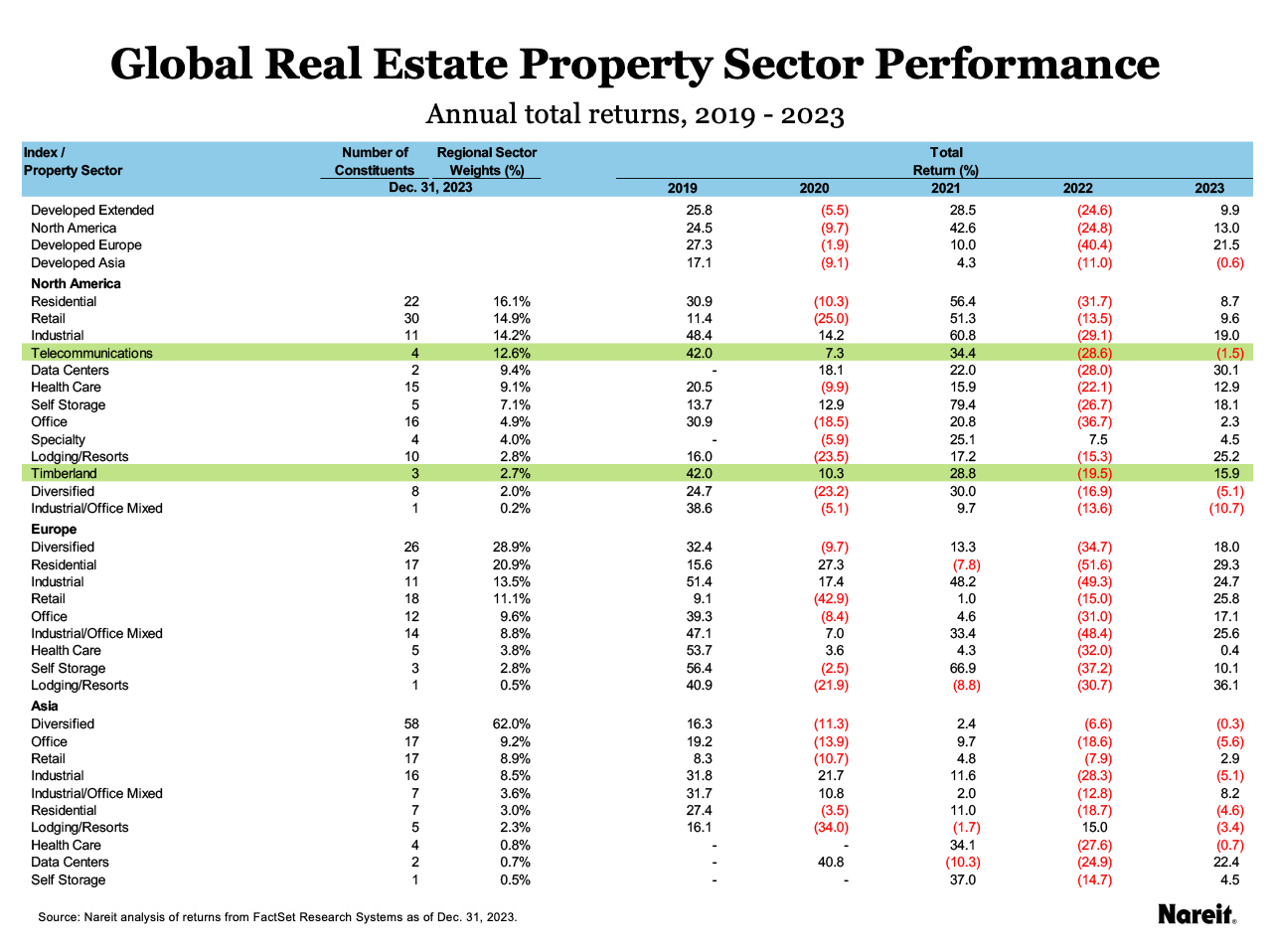

Within the EPRA Nareit Developed series, Europe outperformed the other regions in 2023, with a total return of 21.5%, followed by North America at 13.0% and Asia at -0.6%.

In Europe, lodging/resorts led with a total return of 36.1%, followed by residential at 29.3% and retail at 25.8%. Health care, self-storage, and office lagged, with returns of 0.4%, 10.1%, and 17.1%, respectively.

North America was led by data centers, lodging/resorts, and industrial, with respective returns of 30.1%, 25.2%, and 19.0%. Industrial/office mixed trailed with a return of -10.7%, followed by diversified at -5.1%, and telecommunications at -1.5%.

Data centers also led in Asia, posting a total return of 22.4%, followed by industrial/office mixed at 8.2% and self-storage at 4.5%. Lagging sectors were office at -5.6%, industrial at -5.1%, and residential at -4.6%.