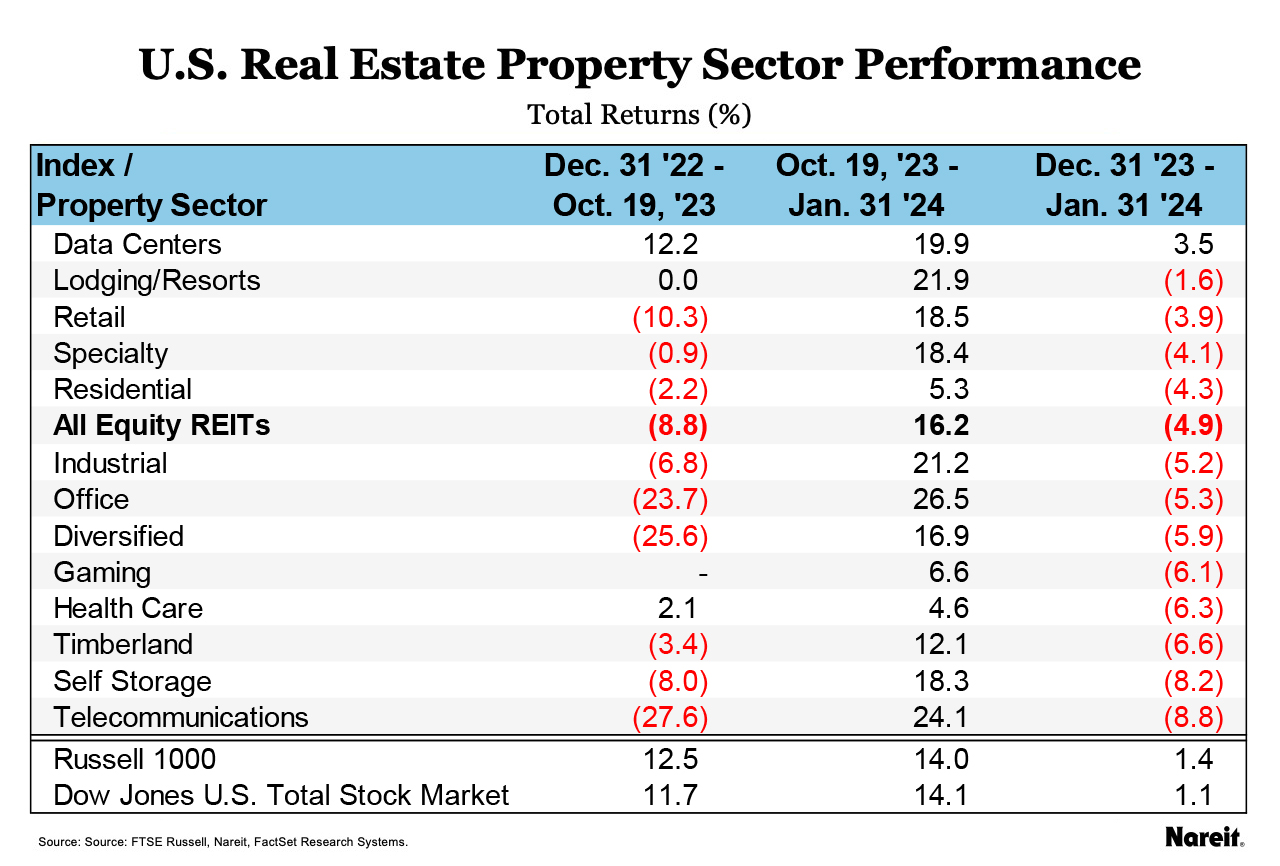

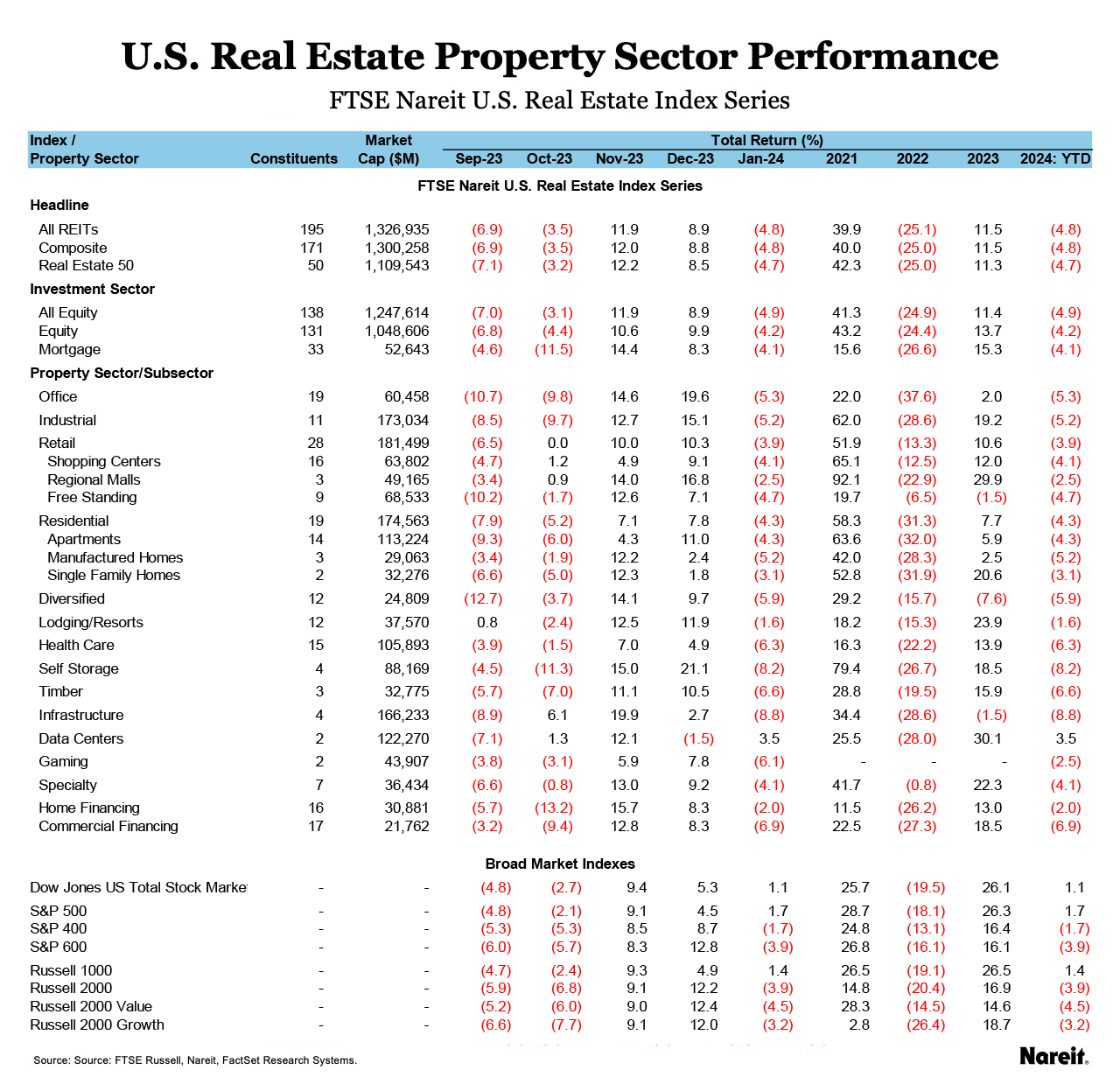

The FTSE Nareit All Equity REITs Index declined 4.9% in January. Broader markets posted narrow gains as the Russell 1000 rose 1.4% and the Dow Jones U.S. Total Stock Market rose 1.1%. Though some investors had expected the Federal Reserve to pivot to a period of more accommodative monetary policy early this year, at their Jan. 31 meeting, the Federal Reserve expressed interest in seeing more evidence that inflation was continuing to decline before moving to cut rates. From Oct. 19–Jan. 31, the All Equity REITs index rose 16.2%. Broader markets were positive over this period as well, as the Dow Jones U.S. Total Stock Market rose 14.1% and the Russell 1000 rose 14.0%. The yield on the 10-Year Treasury ended January at 3.86%, compared to the 4.04% dividend yield on the All Equity REITs index.

As reflected in table 1, REITs largely declined in January after posting strong returns since October. Since Oct. 19, the office sector has led with a total return of 26.5%, followed by telecommunications at 24.1% and lodging/resorts at 21.9%.

As shown in the table above, REITs broadly declined in January. Data centers were the lone positive sector with a total return of 3.5%; lodging/resorts followed with a return of -1.6%. Telecommunications lagged with a return of -8.8%, followed by self-storage at -8.2%.

The FTSE Nareit Mortgage REITs Index also declined in January with a total return of -4.1%. Home financing mREITs declined 2.0% for the month while commercial financing mREITs were down 6.9%.