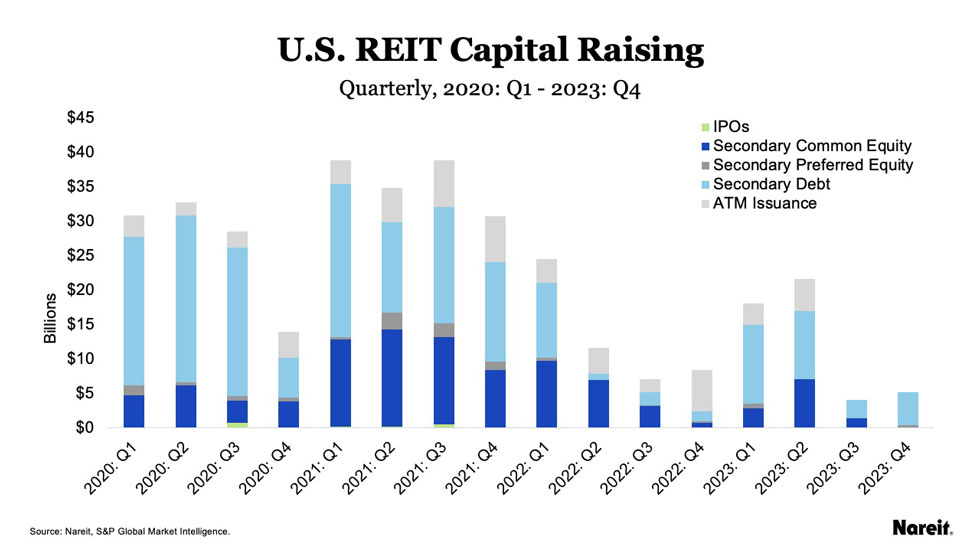

U.S. REITs raised $5.2 billion from debt and equity offerings in the fourth quarter of 2023; note that this total is preliminary and will be revised upward when ATM program usage data become available. $4.8 billion came from debt, $400 million came from preferred equity offerings, and $29 million came from common equity offerings. There were no IPOs. Excluding ATM program usage, the total capital raised represents a 28% increase from the prior quarter, when REITs raised $4.1 billion. ATM program usage grew 8% from $4.7 billion in 2023: Q2 to $5.1 billion in 2023: Q3. In 2023, REITs raised more than $55.1 billion, compared to $51.8 billion in 2022, a figure which includes full year ATM issuance. Nareit’s historical capital offerings summary can be found here.

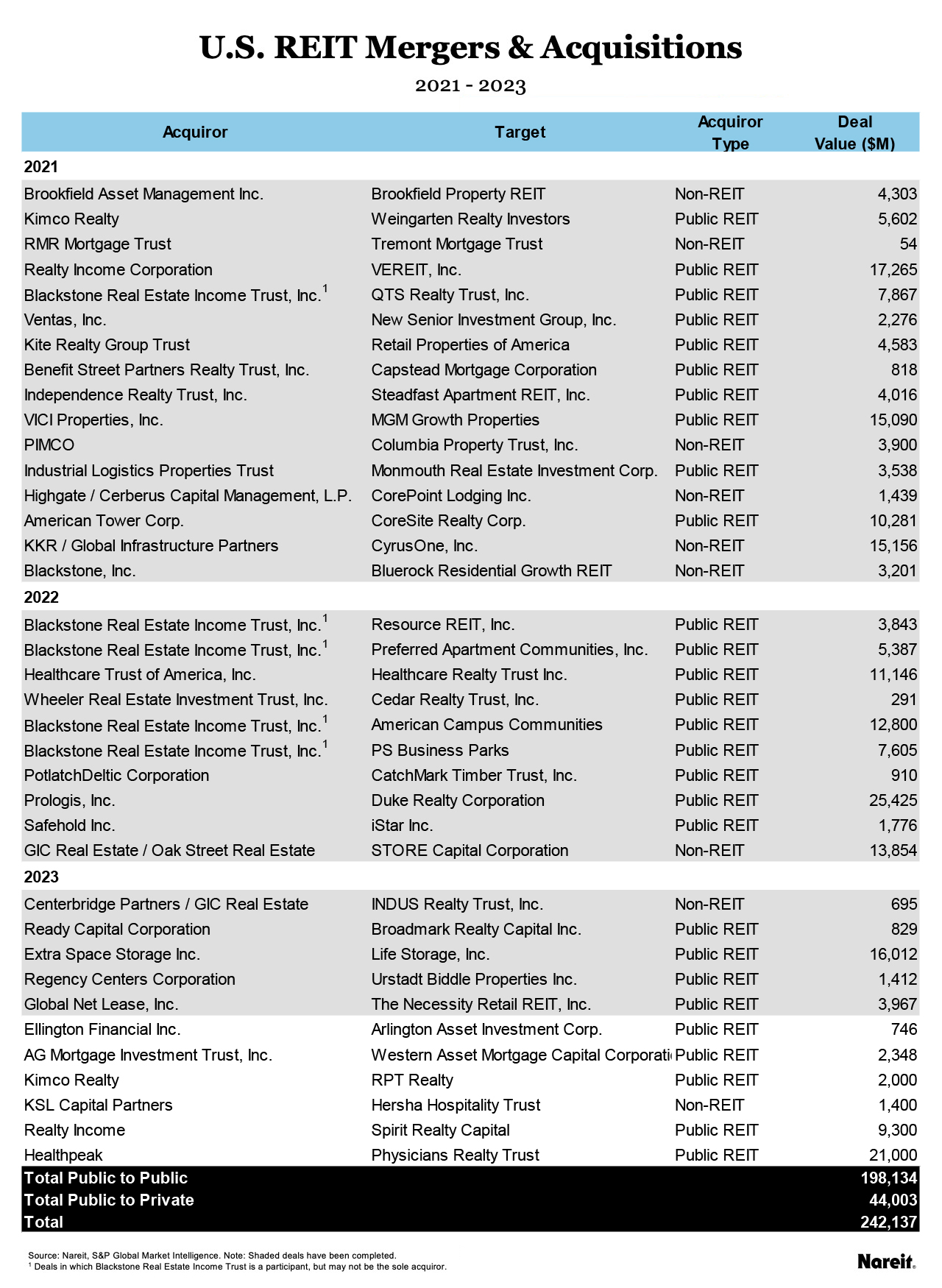

During the quarter, two mergers were announced, reflecting an aggregate deal value of $30.3 billion. In 2022, $83 billion in acquisitions of publicly traded U.S. REITs was announced. Of the $279 billion in public REIT mergers and acquisitions from 2019–2023, 65% of the transaction value represents deals between listed REITs in the same property sector.

2023 Capital Raising

- Non-ATM equity issuance totaled $12.7 billion in 2023, with $11.6 billion from common equity offerings and $1.1 billion in preferred equity offerings. REITs have raised $13.0 billion through ATM offerings based on data available through 2023: Q3. Through that same time period, total equity issuance including ATM offerings was $25.0 billion, with $31.9 billion during the same period in 2022.

- Debt issuance totaled $29.4 billion raised at the secondary market in 2023, up from the $12.9 billion issued in 2022, though down sharply from the $72.6 billion raised in 2021. In 2023, the average yield to maturity for REIT unsecured debt offerings rose to 5.7%, up from 4.7% in 2022.

Mergers & Acquisitions

In 2023, 11 deals to acquire publicly-listed REITs were announced, with a total deal value of $59.8 billion and 96% of the value reflecting acquisitions by listed REITs. In 2022, 10 deals to acquire publicly-listed U.S. REITs were announced, representing a total deal value of $83 billion. Since the beginning of 2021, deals for 37 REITs have been announced or completed. Of the $242.2 billion represented by these acquisitions, 82% is attributed to acquisitions by other public REITs.

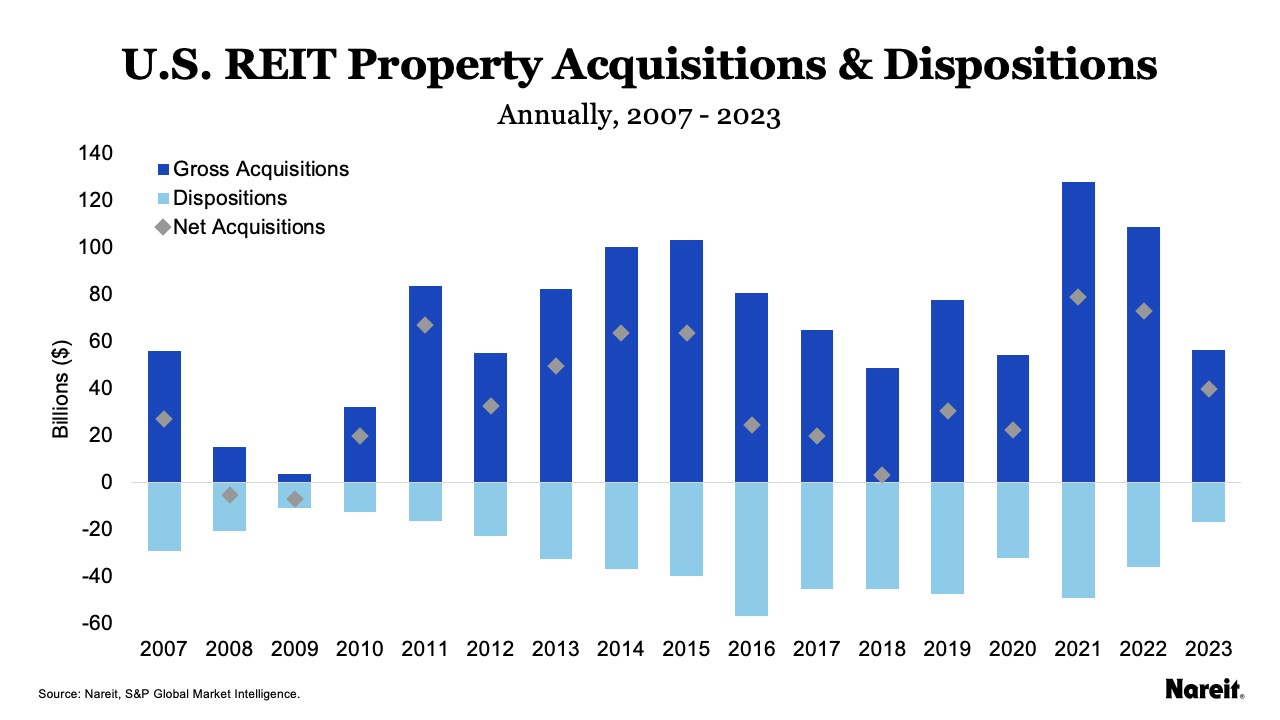

Property Acquisitions & Dispositions

REITs posted $25.1 billion in property acquisitions and $5.8 billion in dispositions in 2023: Q3, with year-to-date totals of $56.6 billion in acquisitions and $16.6 billion in dispositions. In 2022, $108.7 billion in acquisitions and $35.7 billion in dispositions were posted. In 2023: Q3, self-storage, retail, and diversified led with acquisitions of $13.9 billion, $4.3 billion, and $2.1 billion, respectively. See Nareit’s T-Tracker for further details.