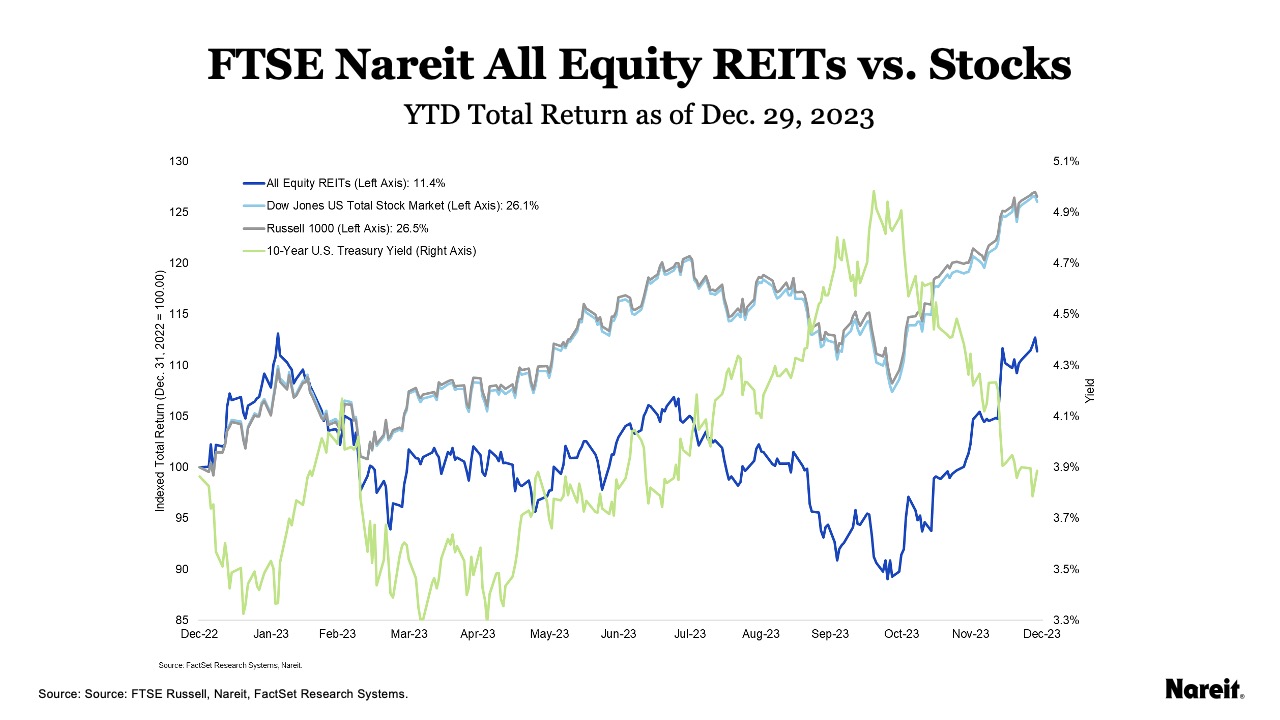

The FTSE Nareit All Equity REITs Index rose 11.4% in 2023, spurred by the expected end to the Federal Reserve’s cycle of monetary policy tightening. REITs, along with broader markets, rose from the middle of October, when the yield on the 10-Year Treasury peaked, through the end of the year. From Oct. 19–Dec. 29, the All Equity REITs index rose 22.1%. Broader markets were positive over this period as well, as the Dow Jones U.S. Total Stock Market rose 12.9% and the Russell 1000 rose 12.4%. The yield on the 10-Year Treasury ended the year at 3.89%.

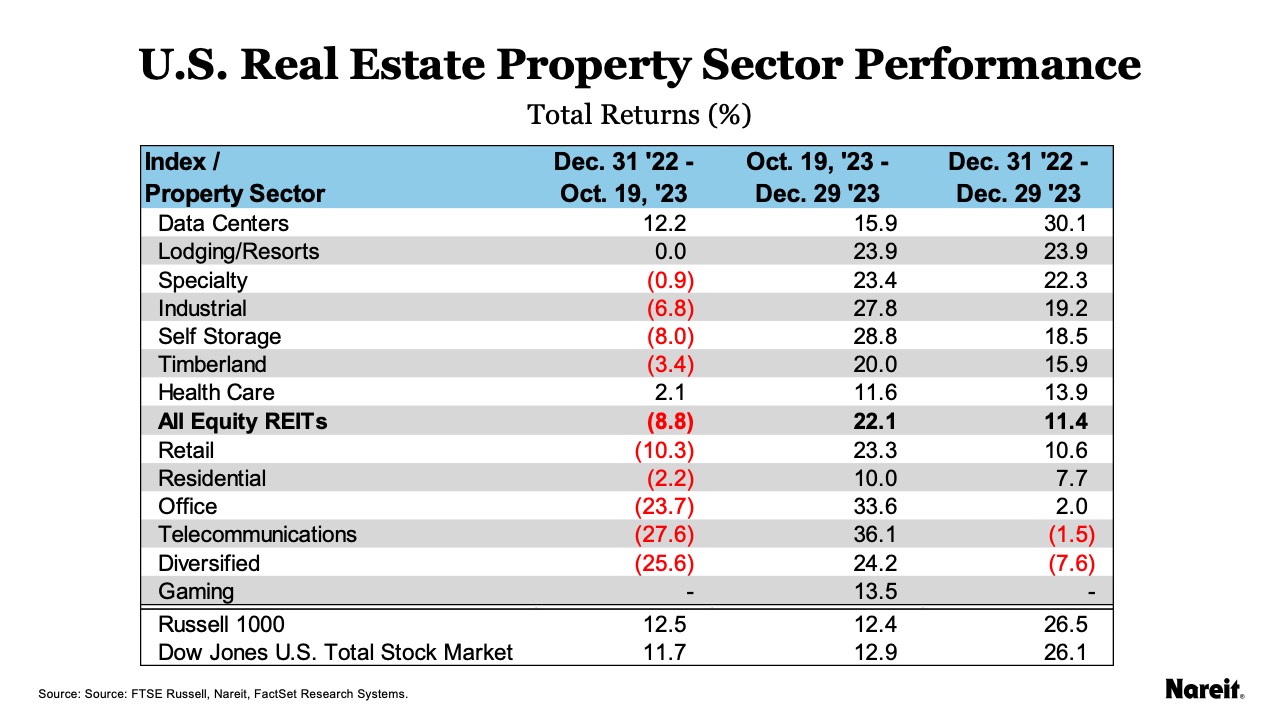

As reflected in the table above, REITs responded positively as Treasury yields declined in the fourth quarter. From Oct. 19 through the end of the year, telecommunications led with a total return of 36.1%, followed by office at 33.6%.

REITs and broader markets rose as the 10-year Treasury declined, as shown in the chart above. REITs underperformed broader markets in 2023 but have outperformed since the 10-Year Treasury peaked in October. Year-to-date total returns through Dec. 29 were:

- All Equity REITs: 11.4%

- Russell 1000: 26.5%

- Dow Jones U.S. Total Stock Market: 26.1%

As shown in the table above, REITs were broadly positive in 2023, led by data centers with a total return of 30.1%, followed by lodging/resorts at 23.9% and specialty at 22.3%. Diversified was down 7.6%, followed by telecommunications, which declined 1.5%.

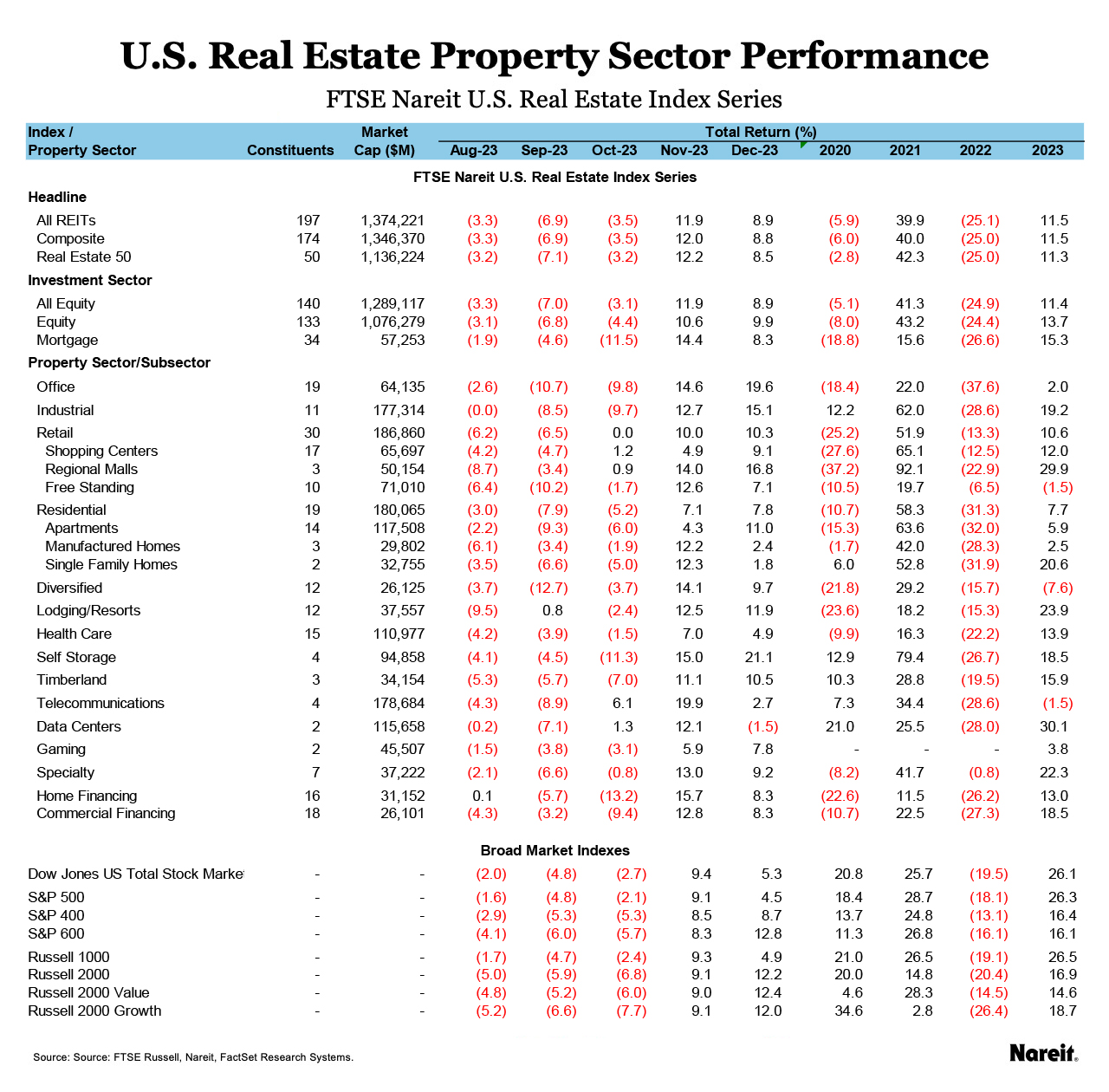

The FTSE Nareit Mortgage REITs Index was also positive in 2023 with a total return of 15.3% for the year. Commercial financing mREITs rose 18.5% in 2023, while home financing mREITs rose 13.0%.